Merit Order Effect Quantification¶

This notebook outlines how the moepy library can be used to quantify the merit order effect of intermittent RES on electricity prices. Please note that the fitted model and estimated results are less accurate than those found in the set of development notebooks, as this notebook is for tutorial purposes the ones found here are using less data and smooth over larger time-periods to reduce computation time.

Imports¶

import pandas as pd

import numpy as np

import pickle

import seaborn as sns

import matplotlib.pyplot as plt

from moepy import moe

Data Loading¶

We'll first load the data in

df_EI = pd.read_csv('../data/ug/electric_insights.csv')

df_EI['local_datetime'] = pd.to_datetime(df_EI['local_datetime'], utc=True)

df_EI = df_EI.set_index('local_datetime')

df_EI.head()

| local_datetime | day_ahead_price | SP | imbalance_price | valueSum | temperature | TCO2_per_h | gCO2_per_kWh | nuclear | biomass | coal | ... | demand | pumped_storage | wind_onshore | wind_offshore | belgian | dutch | french | ireland | northern_ireland | irish |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010-01-01 00:00:00+00:00 | 32.91 | 1 | 55.77 | 55.77 | 1.1 | 16268 | 429 | 7.897 | 0 | 9.902 | ... | 37.948 | -0.435 | nan | nan | 0 | 0 | 1.963 | 0 | 0 | -0.234 |

| 2010-01-01 00:30:00+00:00 | 33.25 | 2 | 59.89 | 59.89 | 1.1 | 16432 | 430 | 7.897 | 0 | 10.074 | ... | 38.227 | -0.348 | nan | nan | 0 | 0 | 1.974 | 0 | 0 | -0.236 |

| 2010-01-01 01:00:00+00:00 | 32.07 | 3 | 53.15 | 53.15 | 1.1 | 16318 | 431 | 7.893 | 0 | 10.049 | ... | 37.898 | -0.424 | nan | nan | 0 | 0 | 1.983 | 0 | 0 | -0.236 |

| 2010-01-01 01:30:00+00:00 | 31.99 | 4 | 38.48 | 38.48 | 1.1 | 15768 | 427 | 7.896 | 0 | 9.673 | ... | 36.918 | -0.575 | nan | nan | 0 | 0 | 1.983 | 0 | 0 | -0.236 |

| 2010-01-01 02:00:00+00:00 | 31.47 | 5 | 37.7 | 37.7 | 1.1 | 15250 | 424 | 7.9 | 0 | 9.37 | ... | 35.961 | -0.643 | nan | nan | 0 | 0 | 1.983 | 0 | 0 | -0.236 |

Generating Predictions¶

We'll use a helper function to both load in our model and make a prediction in a single step

model_fp = '../data/ug/GB_detailed_example_model_p50.pkl'

dt_pred = pd.date_range('2020-01-01', '2021-01-01').tz_localize('Europe/London')

df_pred = moe.construct_df_pred(model_fp, dt_pred=dt_pred)

df_pred.head()

| Unnamed: 0 | 2020-01-01 00:00:00+00:00 | 2020-01-02 00:00:00+00:00 | 2020-01-03 00:00:00+00:00 | 2020-01-04 00:00:00+00:00 | 2020-01-05 00:00:00+00:00 | 2020-01-06 00:00:00+00:00 | 2020-01-07 00:00:00+00:00 | 2020-01-08 00:00:00+00:00 | 2020-01-09 00:00:00+00:00 | 2020-01-10 00:00:00+00:00 | ... | 2020-12-23 00:00:00+00:00 | 2020-12-24 00:00:00+00:00 | 2020-12-25 00:00:00+00:00 | 2020-12-26 00:00:00+00:00 | 2020-12-27 00:00:00+00:00 | 2020-12-28 00:00:00+00:00 | 2020-12-29 00:00:00+00:00 | 2020-12-30 00:00:00+00:00 | 2020-12-31 00:00:00+00:00 | 2021-01-01 00:00:00+00:00 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -2 | -18.5313 | -18.5192 | -18.5074 | -18.4956 | -18.484 | -18.4725 | -18.4612 | -18.45 | -18.4389 | -18.428 | ... | -14.4174 | -14.4159 | -14.4146 | -14.4136 | -14.4128 | -14.4121 | -14.4117 | -14.4114 | -14.4112 | -14.4111 |

| -1.9 | -18.2762 | -18.2642 | -18.2524 | -18.2407 | -18.2292 | -18.2178 | -18.2065 | -18.1954 | -18.1843 | -18.1735 | ... | -14.1843 | -14.1828 | -14.1816 | -14.1805 | -14.1797 | -14.1791 | -14.1786 | -14.1783 | -14.1781 | -14.178 |

| -1.8 | -18.0218 | -18.0099 | -17.9982 | -17.9865 | -17.9751 | -17.9637 | -17.9525 | -17.9414 | -17.9304 | -17.9196 | ... | -13.9519 | -13.9504 | -13.9491 | -13.9481 | -13.9472 | -13.9466 | -13.9462 | -13.9458 | -13.9457 | -13.9456 |

| -1.7 | -17.7681 | -17.7563 | -17.7446 | -17.733 | -17.7216 | -17.7103 | -17.6991 | -17.6881 | -17.6772 | -17.6665 | ... | -13.72 | -13.7185 | -13.7172 | -13.7162 | -13.7154 | -13.7148 | -13.7143 | -13.714 | -13.7138 | -13.7137 |

| -1.6 | -17.5151 | -17.5033 | -17.4917 | -17.4802 | -17.4688 | -17.4576 | -17.4465 | -17.4355 | -17.4247 | -17.414 | ... | -13.4887 | -13.4872 | -13.4859 | -13.4849 | -13.4841 | -13.4835 | -13.483 | -13.4827 | -13.4825 | -13.4824 |

We can now use moe.construct_pred_ts to generate a prediction time-series from our surface estimation and the observed dispatchable generation

s_dispatchable = (df_EI_model['demand'] - df_EI_model[['solar', 'wind']].sum(axis=1)).dropna().loc[:df_pred.columns[-2]+pd.Timedelta(hours=23, minutes=30)]

s_pred_ts = moe.construct_pred_ts(s_dispatchable['2020'], df_pred)

s_pred_ts.head()

local_datetime

2020-01-01 00:00:00+00:00 32.080126

2020-01-01 00:30:00+00:00 32.627349

2020-01-01 01:00:00+00:00 32.296901

2020-01-01 01:30:00+00:00 31.561614

2020-01-01 02:00:00+00:00 31.078722

dtype: float64

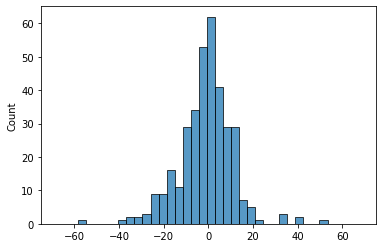

We can visualise the error distribution to see how our model is performing

To reduce this error the resolution of the date-smoothing and LOWESS fit can be increased, this is what was done for the research paper and is shown in the set of development notebooks. Looking at 2020 also increases the error somewhat.

s_price = df_EI['day_ahead_price']

s_err = s_pred_ts - s_price.loc[s_pred_ts.index]

print(s_err.abs().mean())

sns.histplot(s_err)

_ = plt.xlim(-75, 75)

8.897118237665632

Calculating the MOE¶

To calculate the MOE we have to generate a counterfactual price, in this case the estimate is of the cost of electricity if RES had not been on the system. Subtracting the simulated price from the counterfactual price results in a time-series of our simulated MOE.

s_demand = df_EI_model.loc[s_dispatchable.index, 'demand']

s_demand_pred_ts = moe.construct_pred_ts(s_demand['2020'], df_pred)

s_MOE = s_demand_pred_ts - s_pred_ts

s_MOE = s_MOE.dropna()

s_MOE.mean() # N.b for the reasons previously mentioned this particular value is inaccurate

11.215738750384316