Price Merit Order Effect Analysis¶

This notebook outlines the analysis required to determine the price merit-order-effect of variable renewable generation in the GB and DE power markets.

Imports¶

#exports

import json

import pandas as pd

import numpy as np

import pickle

import scipy

from sklearn import linear_model

from sklearn.metrics import r2_score

from collections.abc import Iterable

import seaborn as sns

import matplotlib as mpl

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

from tqdm import tqdm

from IPython.display import JSON

from moepy import lowess, eda

from moepy.surface import PicklableFunction

User Inputs¶

GB_model_fp = '../data/models/DAM_price_GB_p50.pkl'

DE_model_fp = '../data/models/DAM_price_DE_p50.pkl'

load_existing_GB_model = True

load_existing_DE_model = True

Estimating the Price Surface¶

We'll start by loading in the data

%%time

df_EI = eda.load_EI_df('../data/raw/electric_insights.csv')

df_EI.head()

Wall time: 1.76 s

| local_datetime | day_ahead_price | SP | imbalance_price | valueSum | temperature | TCO2_per_h | gCO2_per_kWh | nuclear | biomass | coal | ... | demand | pumped_storage | wind_onshore | wind_offshore | belgian | dutch | french | ireland | northern_ireland | irish |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2009-01-01 00:00:00+00:00 | 58.05 | 1 | 74.74 | 74.74 | -0.6 | 21278 | 555 | 6.973 | 0 | 17.65 | ... | 38.329 | -0.404 | nan | nan | 0 | 0 | 1.977 | 0 | 0 | -0.161 |

| 2009-01-01 00:30:00+00:00 | 56.33 | 2 | 74.89 | 74.89 | -0.6 | 21442 | 558 | 6.968 | 0 | 17.77 | ... | 38.461 | -0.527 | nan | nan | 0 | 0 | 1.977 | 0 | 0 | -0.16 |

| 2009-01-01 01:00:00+00:00 | 52.98 | 3 | 76.41 | 76.41 | -0.6 | 21614 | 569 | 6.97 | 0 | 18.07 | ... | 37.986 | -1.018 | nan | nan | 0 | 0 | 1.977 | 0 | 0 | -0.16 |

| 2009-01-01 01:30:00+00:00 | 50.39 | 4 | 37.73 | 37.73 | -0.6 | 21320 | 578 | 6.969 | 0 | 18.022 | ... | 36.864 | -1.269 | nan | nan | 0 | 0 | 1.746 | 0 | 0 | -0.16 |

| 2009-01-01 02:00:00+00:00 | 48.7 | 5 | 59 | 59 | -0.6 | 21160 | 585 | 6.96 | 0 | 17.998 | ... | 36.18 | -1.566 | nan | nan | 0 | 0 | 1.73 | 0 | 0 | -0.16 |

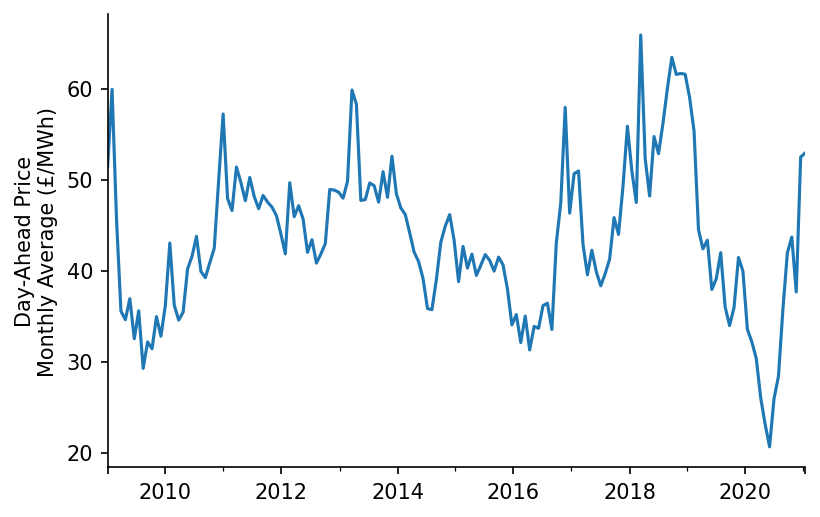

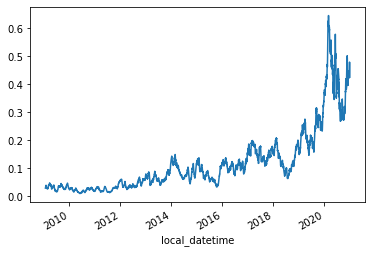

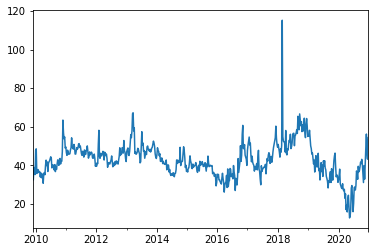

We'll do a quick plot of the average price

fig, ax = plt.subplots(dpi=150)

df_EI['day_ahead_price'].resample('4W').mean().plot(ax=ax)

eda.hide_spines(ax)

ax.set_xlabel('')

ax.set_ylabel('Day-Ahead Price\nMonthly Average (£/MWh)')

Text(0, 0.5, 'Day-Ahead Price\nMonthly Average (£/MWh)')

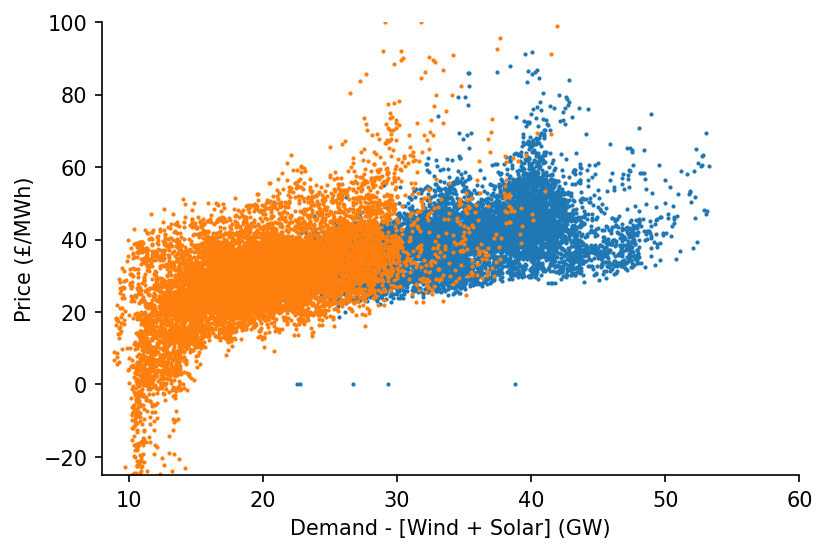

We'll also visualise individual half-hour periods for two different date ranges in the dataset

df_EI_model = df_EI[['day_ahead_price', 'demand', 'solar', 'wind']].dropna()

s_price = df_EI_model['day_ahead_price']

s_dispatchable = df_EI_model['demand'] - df_EI_model[['solar', 'wind']].sum(axis=1)

# Plotting

fig, ax = plt.subplots(dpi=150)

ax.scatter(s_dispatchable['2010-03':'2010-09'], s_price['2010-03':'2010-09'], s=1)

ax.scatter(s_dispatchable['2020-03':'2020-09'], s_price['2020-03':'2020-09'], s=1)

eda.hide_spines(ax)

ax.set_xlim(8, 60)

ax.set_ylim(-25, 100)

ax.set_xlabel('Demand - [Wind + Solar] (GW)')

ax.set_ylabel('Price (£/MWh)')

Text(0, 0.5, 'Price (£/MWh)')

Next we'll load in (or fit) one of the models trained in the previous notebook

%%time

if load_existing_GB_model == True:

smooth_dates = pickle.load(open(GB_model_fp, 'rb'))

else:

reg_dates = pd.date_range('2009-01-01', '2021-01-01', freq='13W')

smooth_dates = lowess.SmoothDates()

smooth_dates.fit(s_dispatchable.values, s_price.values, dt_idx=s_dispatchable.index,

reg_dates=reg_dates, frac=0.3, num_fits=31, threshold_value=26)

pickle.dump(smooth_dates, open(model_fp, 'wb'))

Wall time: 2.42 s

We're now ready to make our price curve predictions, we'll make one for each day that the model used in training

%%time

x_pred = np.linspace(3, 61, 581)

dt_pred = pd.date_range('2009-01-01', '2020-12-31', freq='1D')

df_pred = smooth_dates.predict(x_pred=x_pred, dt_pred=dt_pred)

df_pred.index = np.round(df_pred.index, 1)

df_pred.head()

Wall time: 469 ms

| Unnamed: 0 | 2009-01-01 | 2009-01-02 | 2009-01-03 | 2009-01-04 | 2009-01-05 | 2009-01-06 | 2009-01-07 | 2009-01-08 | 2009-01-09 | 2009-01-10 | ... | 2020-12-22 | 2020-12-23 | 2020-12-24 | 2020-12-25 | 2020-12-26 | 2020-12-27 | 2020-12-28 | 2020-12-29 | 2020-12-30 | 2020-12-31 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 3 | -17.4948 | -17.5178 | -17.5406 | -17.5632 | -17.5856 | -17.6077 | -17.6297 | -17.6514 | -17.673 | -17.6943 | ... | 0.194247 | 0.203242 | 0.212319 | 0.221479 | 0.230719 | 0.240041 | 0.249444 | 0.258926 | 0.268489 | 0.278132 |

| 3.1 | -17.2964 | -17.3193 | -17.3421 | -17.3646 | -17.3869 | -17.409 | -17.4309 | -17.4525 | -17.474 | -17.4953 | ... | 0.404498 | 0.413478 | 0.42254 | 0.431683 | 0.440907 | 0.450212 | 0.459598 | 0.469064 | 0.478609 | 0.488234 |

| 3.2 | -17.0983 | -17.1212 | -17.1439 | -17.1663 | -17.1886 | -17.2106 | -17.2324 | -17.254 | -17.2754 | -17.2966 | ... | 0.614692 | 0.623656 | 0.632702 | 0.641829 | 0.651037 | 0.660326 | 0.669695 | 0.679143 | 0.688671 | 0.698278 |

| 3.3 | -16.9006 | -16.9234 | -16.946 | -16.9684 | -16.9905 | -17.0125 | -17.0342 | -17.0558 | -17.0771 | -17.0983 | ... | 0.824815 | 0.833764 | 0.842794 | 0.851906 | 0.861097 | 0.87037 | 0.879722 | 0.889153 | 0.898664 | 0.908253 |

| 3.4 | -16.7031 | -16.7259 | -16.7484 | -16.7707 | -16.7928 | -16.8147 | -16.8364 | -16.8579 | -16.8791 | -16.9002 | ... | 1.03486 | 1.04379 | 1.0528 | 1.0619 | 1.07108 | 1.08033 | 1.08967 | 1.09908 | 1.10858 | 1.11815 |

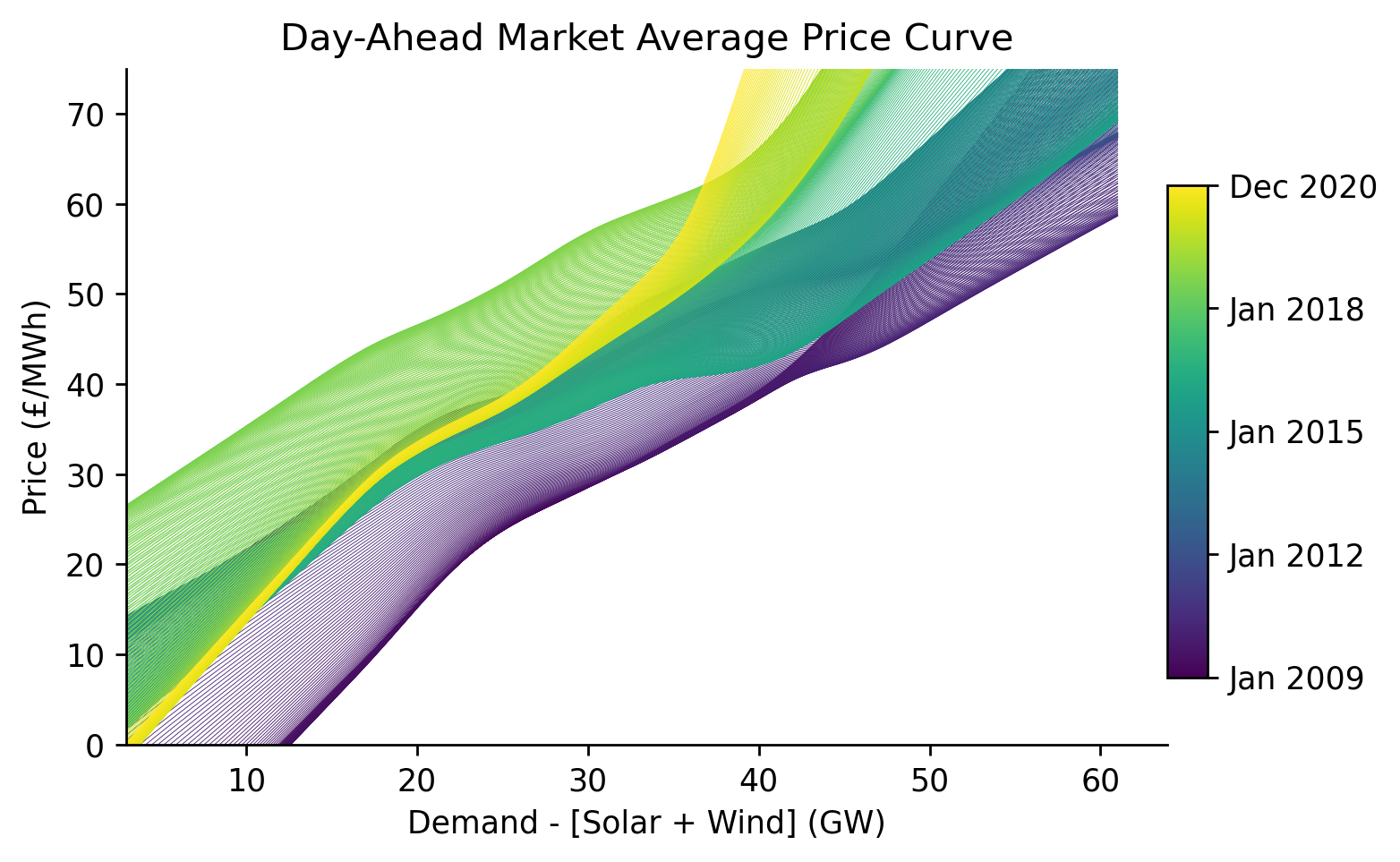

Visualising the Price Surface¶

We now want to actually visualise the results of our model, in particular the price surface it's fitted. We'll start by plotting all of the price curves overlapping each other.

cmap = plt.get_cmap('viridis')

cbar_ticks = [0, 0.25, 0.5, 0.75, 1]

# Plotting

fig, ax = plt.subplots(dpi=250)

lp = df_pred.loc[:, ::7].plot(legend=False, cmap=cmap, linewidth=0.25, ax=ax)

cax = fig.add_axes([0.9, 0.2, 0.03, 0.55])

cbar = mpl.colorbar.ColorbarBase(cax, orientation='vertical', cmap=cmap, ticks=cbar_ticks)

cbar.ax.set_yticklabels([dt_pred[min(int(len(dt_pred)*tick_loc), len(dt_pred)-1)].strftime('%b %Y') for tick_loc in cbar_ticks])

eda.hide_spines(ax)

ax.set_xlabel('Demand - [Solar + Wind] (GW)')

ax.set_ylabel('Price (£/MWh)')

ax.set_xlim(df_pred.index[0])

ax.set_ylim(0, 75)

ax.set_title('Day-Ahead Market Average Price Curve')

Text(0.5, 1.0, 'Day-Ahead Market Average Price Curve')

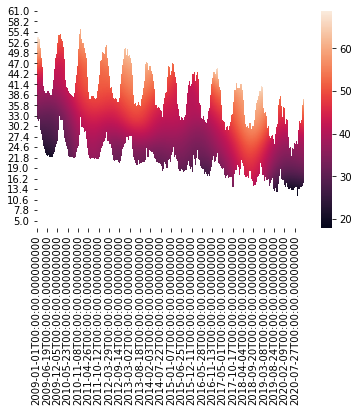

Whilst the previous plot might look quite nice it's rather difficult to interpret, an alternative way to visualise how the price curve evolves over time is using a heatmap

#exports

def construct_dispatchable_lims_df(s_dispatchable, rolling_w=3, daily_quantiles=[0.001, 0.999]):

"""Identifies the rolling limits to be used in masking"""

df_dispatchable_lims = (s_dispatchable

.resample('1d')

.quantile(daily_quantiles)

.unstack()

.rolling(rolling_w*7)

.mean()

.bfill()

.ffill()

.iloc[:-1, :]

)

df_dispatchable_lims.index = pd.to_datetime(df_dispatchable_lims.index.strftime('%Y-%m-%d'))

return df_dispatchable_lims

def construct_pred_mask_df(df_pred, df_dispatchable_lims):

"""Constructs a DataFrame mask for the prediction"""

df_pred = df_pred[df_dispatchable_lims.index]

df_pred_mask = pd.DataFrame(dict(zip(df_pred.columns, [df_pred.index]*df_pred.shape[1])), index=df_pred.index)

df_pred_mask = (df_pred_mask > df_dispatchable_lims.iloc[:, 0].values) & (df_pred_mask < df_dispatchable_lims.iloc[:, 1].values)

df_pred.columns = pd.to_datetime(df_pred.columns)

df_pred_mask.columns = pd.to_datetime(df_pred_mask.columns)

return df_pred_mask

df_dispatchable_lims = construct_dispatchable_lims_df(s_dispatchable)

df_pred_mask = construct_pred_mask_df(df_pred, df_dispatchable_lims)

sns.heatmap(df_pred.where(df_pred_mask, np.nan).iloc[::-1])

<AxesSubplot:>

The default output for seaborn heatmaps never looks great when one of the axis is a datetime, we'll write a custom class and wrapper to handle this

#exports

class AxTransformer:

"""Helper class for cleaning axis tick locations and labels"""

def __init__(self, datetime_vals=False):

self.datetime_vals = datetime_vals

self.lr = linear_model.LinearRegression()

return

def process_tick_vals(self, tick_vals):

if not isinstance(tick_vals, Iterable) or isinstance(tick_vals, str):

tick_vals = [tick_vals]

if self.datetime_vals == True:

tick_vals = pd.to_datetime(tick_vals).astype(int).values

tick_vals = np.array(tick_vals)

return tick_vals

def fit(self, ax, axis='x'):

axis = getattr(ax, f'get_{axis}axis')()

tick_locs = axis.get_ticklocs()

tick_vals = self.process_tick_vals([label._text for label in axis.get_ticklabels()])

self.lr.fit(tick_vals.reshape(-1, 1), tick_locs)

return

def transform(self, tick_vals):

tick_vals = self.process_tick_vals(tick_vals)

tick_locs = self.lr.predict(np.array(tick_vals).reshape(-1, 1))

return tick_locs

def set_ticks(ax, tick_locs, tick_labels=None, axis='y'):

"""Sets ticks at standard numerical locations"""

if tick_labels is None:

tick_labels = tick_locs

ax_transformer = AxTransformer()

ax_transformer.fit(ax, axis=axis)

getattr(ax, f'set_{axis}ticks')(ax_transformer.transform(tick_locs))

getattr(ax, f'set_{axis}ticklabels')(tick_labels)

ax.tick_params(axis=axis, which='both', bottom=True, top=False, labelbottom=True)

return ax

def set_date_ticks(ax, start_date, end_date, axis='y', date_format='%Y-%m-%d', **date_range_kwargs):

"""Sets ticks at datetime locations"""

dt_rng = pd.date_range(start_date, end_date, **date_range_kwargs)

ax_transformer = AxTransformer(datetime_vals=True)

ax_transformer.fit(ax, axis=axis)

getattr(ax, f'set_{axis}ticks')(ax_transformer.transform(dt_rng))

getattr(ax, f'set_{axis}ticklabels')(dt_rng.strftime(date_format))

ax.tick_params(axis=axis, which='both', bottom=True, top=False, labelbottom=True)

return ax

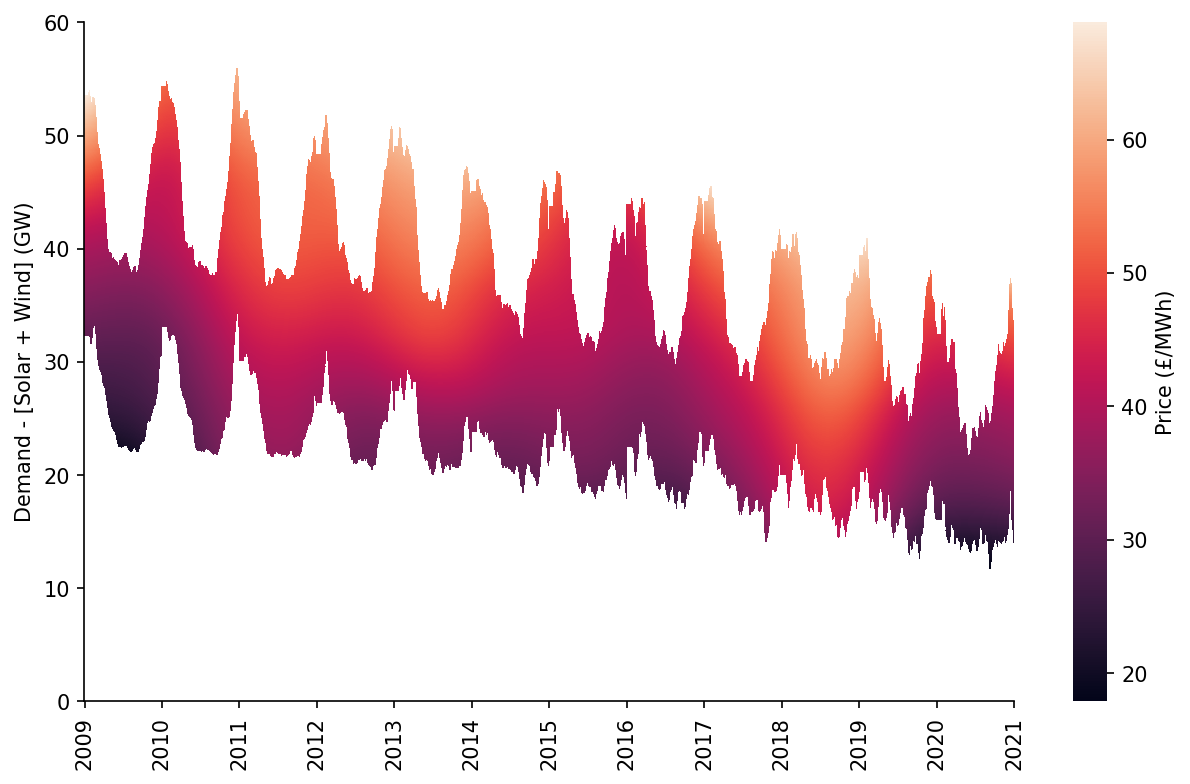

%%time

fig, ax = plt.subplots(dpi=150, figsize=(10, 6))

htmp = sns.heatmap(df_pred[10:60].where(df_pred_mask[10:60], np.nan).iloc[::-1], ax=ax, cbar_kws={'label': 'Price (£/MWh)'})

set_ticks(ax, np.arange(0, 70, 10), axis='y')

set_date_ticks(ax, '2009-01-01', '2021-01-01', freq='1YS', date_format='%Y', axis='x')

for _, spine in htmp.spines.items():

spine.set_visible(True)

eda.hide_spines(ax)

ax.set_ylabel('Demand - [Solar + Wind] (GW)')

Wall time: 1.79 s

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\sklearn\utils\validation.py:63: FutureWarning: Arrays of bytes/strings is being converted to decimal numbers if dtype='numeric'. This behavior is deprecated in 0.24 and will be removed in 1.1 (renaming of 0.26). Please convert your data to numeric values explicitly instead.

return f(*args, **kwargs)

Text(144.58333333333331, 0.5, 'Demand - [Solar + Wind] (GW)')

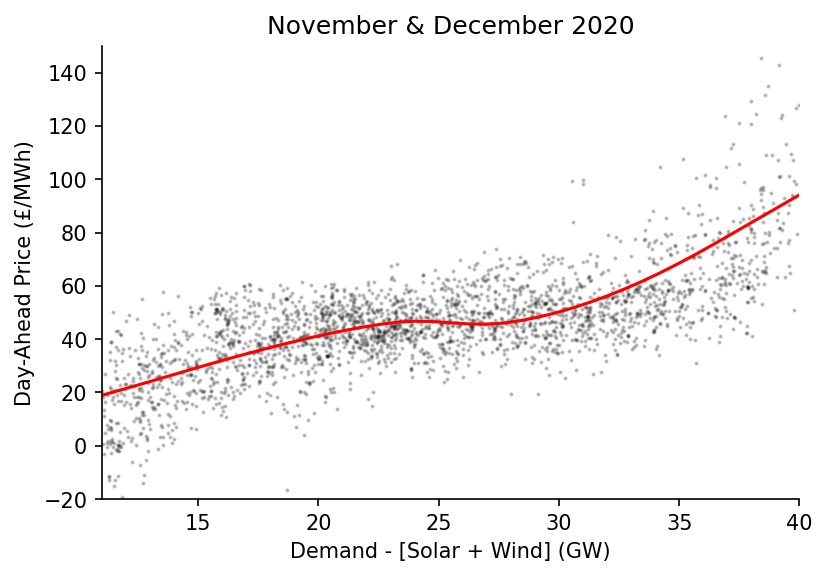

We also want to visualise specific date ranges, here we'll look towards the end of 2020

%%time

center_date = '2020-12-01'

dt_min = pd.to_datetime(center_date) - pd.Timedelta(weeks=4)

dt_max = pd.to_datetime(center_date) + pd.Timedelta(weeks=4)

x = s_dispatchable[dt_min:dt_max].values

y = s_price.loc[s_dispatchable.index][dt_min:dt_max].values

x_pred = np.linspace(11, 40, 41)

y_pred = lowess.lowess_fit_and_predict(x, y, frac=0.6, num_fits=25, x_pred=x_pred)

# Plotting

fig, ax = plt.subplots(dpi=150)

ax.plot(x_pred, y_pred, linewidth=1.5, color='r')

ax.scatter(x, y, color='k', s=1, alpha=0.2)

ax.set_title(f'November & December 2020') # remove in the LaTeX plot and just state in the caption

ax.set_xlim(11, 40)

ax.set_ylim(-20, 150)

eda.hide_spines(ax)

ax.set_xlabel('Demand - [Solar + Wind] (GW)')

ax.set_ylabel('Day-Ahead Price (£/MWh)')

Wall time: 58.1 ms

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\pandas\core\indexes\base.py:5277: FutureWarning: Indexing a timezone-aware DatetimeIndex with a timezone-naive datetime is deprecated and will raise KeyError in a future version. Use a timezone-aware object instead.

start_slice, end_slice = self.slice_locs(start, end, step=step, kind=kind)

Text(0, 0.5, 'Day-Ahead Price (£/MWh)')

Evaluating the Price Curve Predictions¶

#exports

def construct_df_pred(model_fp, x_pred=np.linspace(-2, 61, 631), dt_pred=pd.date_range('2009-01-01', '2020-12-31', freq='1D')):

"""Constructs the prediction surface for the specified pre-fitted model"""

smooth_dates = pickle.load(open(model_fp, 'rb'))

df_pred = smooth_dates.predict(x_pred=x_pred, dt_pred=dt_pred)

df_pred.index = np.round(df_pred.index, 1)

return df_pred

model_fp = '../data/models/DAM_price_average.pkl'

df_pred = construct_df_pred(model_fp)

df_pred.head()

| Unnamed: 0 | 2009-01-01 | 2009-01-02 | 2009-01-03 | 2009-01-04 | 2009-01-05 | 2009-01-06 | 2009-01-07 | 2009-01-08 | 2009-01-09 | 2009-01-10 | ... | 2020-12-22 | 2020-12-23 | 2020-12-24 | 2020-12-25 | 2020-12-26 | 2020-12-27 | 2020-12-28 | 2020-12-29 | 2020-12-30 | 2020-12-31 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -2 | -28.4122 | -28.4306 | -28.4488 | -28.4668 | -28.4846 | -28.5022 | -28.5197 | -28.5369 | -28.554 | -28.5708 | ... | -17.5465 | -17.5399 | -17.5331 | -17.5263 | -17.5194 | -17.5125 | -17.5054 | -17.4982 | -17.4909 | -17.4836 |

| -1.9 | -28.2171 | -28.2354 | -28.2536 | -28.2715 | -28.2893 | -28.3068 | -28.3242 | -28.3414 | -28.3584 | -28.3752 | ... | -17.2979 | -17.2913 | -17.2846 | -17.2778 | -17.2709 | -17.2639 | -17.2568 | -17.2496 | -17.2424 | -17.235 |

| -1.8 | -28.022 | -28.0403 | -28.0583 | -28.0762 | -28.0939 | -28.1115 | -28.1288 | -28.1459 | -28.1629 | -28.1796 | ... | -17.0494 | -17.0427 | -17.036 | -17.0292 | -17.0223 | -17.0153 | -17.0082 | -17.001 | -16.9938 | -16.9864 |

| -1.7 | -27.8269 | -27.8451 | -27.8631 | -27.881 | -27.8986 | -27.9161 | -27.9334 | -27.9504 | -27.9673 | -27.984 | ... | -16.8008 | -16.7941 | -16.7874 | -16.7806 | -16.7737 | -16.7667 | -16.7596 | -16.7524 | -16.7451 | -16.7378 |

| -1.6 | -27.6318 | -27.65 | -27.6679 | -27.6857 | -27.7033 | -27.7207 | -27.7379 | -27.7549 | -27.7718 | -27.7884 | ... | -16.5522 | -16.5455 | -16.5388 | -16.532 | -16.5251 | -16.5181 | -16.511 | -16.5038 | -16.4965 | -16.4891 |

Now we've created our prediction dataframe we can calculate a time-series for our price prediction

N.b. to speed things up every 100th half-hour has been sampled rather than using the full dataset

#exports

def construct_pred_ts(s, df_pred):

"""Uses the time-adaptive LOWESS surface to generate time-series prediction"""

s_pred_ts = pd.Series(index=s.index, dtype='float64')

for dt_idx, val in tqdm(s.iteritems(), total=s.size):

s_pred_ts.loc[dt_idx] = df_pred.loc[round(val, 1), dt_idx.strftime('%Y-%m-%d')]

return s_pred_ts

s_dispatchable = (df_EI_model['demand'] - df_EI_model[['solar', 'wind']].sum(axis=1)).dropna().loc[:df_pred.columns.max()+pd.Timedelta(hours=23, minutes=30)]

s_pred_ts = construct_pred_ts(s_dispatchable.iloc[::100].iloc[:-1], df_pred)

s_pred_ts.head()

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\pandas\core\indexes\base.py:5277: FutureWarning: Indexing a timezone-aware DatetimeIndex with a timezone-naive datetime is deprecated and will raise KeyError in a future version. Use a timezone-aware object instead.

start_slice, end_slice = self.slice_locs(start, end, step=step, kind=kind)

local_datetime

2009-01-01 00:00:00+00:00 39.026220

2009-01-03 02:00:00+00:00 34.314689

2009-01-05 04:00:00+00:00 32.502689

2009-01-07 06:00:00+00:00 42.705269

2009-01-09 08:00:00+00:00 64.025113

dtype: float64

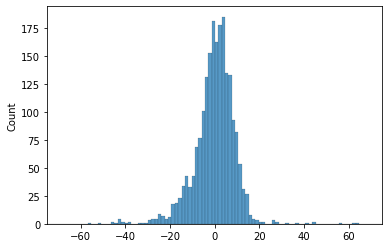

We'll quickly inspect the error distribution

s_price = df_EI['day_ahead_price']

s_err = s_pred_ts - s_price.loc[s_pred_ts.index]

print(s_err.abs().mean())

sns.histplot(s_err)

_ = plt.xlim(-75, 75)

6.8625170828105615

We'll quickly calculate the r2 score for this model, for context the UK day-ahead price multiple linear regression model from the Staffell/Green group achieved an adjusted r2 of 0.451

r2_score(s_price.loc[s_pred_ts.index], s_pred_ts)

0.46527623686663677

Now we'll calculate some error metrics, including the option to remove extreme error outliers

#exports

def calc_error_metrics(s_err, max_err_quantile=1):

"""Calculates several error metrics using the passed error series"""

if s_err.isnull().sum() > 0:

s_err = s_err.dropna()

max_err_cutoff = s_err.abs().quantile(max_err_quantile)

s_err = s_err[s_err.abs()<=max_err_cutoff]

metrics = {

'median_abs_err': s_err.abs().median(),

'mean_abs_err': s_err.abs().mean(),

'root_mean_square_error': np.sqrt((s_err**2).mean())

}

return metrics

metrics = calc_error_metrics(s_err)

metrics

{'median_abs_err': 4.843738852384298,

'mean_abs_err': 6.8625170828105615,

'root_mean_square_error': 12.301327313943641}

We'll now create a wrapper for the last few steps and repeat the analysis for four variants of the model

#exports

def get_model_pred_ts(s, model_fp, s_demand=None, x_pred=np.linspace(-2, 61, 631), dt_pred=pd.date_range('2009-01-01', '2020-12-31', freq='1D')):

"""Constructs the time-series prediction for the specified pre-fitted model"""

df_pred = construct_df_pred(model_fp, x_pred=x_pred, dt_pred=dt_pred)

s_cleaned = s.dropna().loc[df_pred.columns.min():df_pred.columns.max()+pd.Timedelta(hours=23, minutes=30)]

s_pred_ts = construct_pred_ts(s_cleaned, df_pred)

if s_demand is None:

return s_pred_ts

else:

s_cleaned = s_demand.dropna().loc[df_pred.columns.min():df_pred.columns.max()+pd.Timedelta(hours=23, minutes=30)]

s_pred_ts_demand = construct_pred_ts(s_cleaned, df_pred)

return s_pred_ts, s_pred_ts_demand

s_demand = df_EI['demand']

s_price = df_EI['day_ahead_price']

s_dispatchable = df_EI_model['demand'] - df_EI_model[['solar', 'wind']].sum(axis=1)

model_runs = {

'demand_p50': {

'model_fp': '../data/models/DAM_price_demand_p50.pkl',

's': s_demand

},

'demand_avg': {

'model_fp': '../data/models/DAM_price_demand_average.pkl',

's': s_demand

},

'dispatch_p50': {

'model_fp': '../data/models/DAM_price_p50.pkl',

's': s_dispatchable

},

'dispatch_avg': {

'model_fp': '../data/models/DAM_price_average.pkl',

's': s_dispatchable

},

}

model_outputs = dict()

for model_name, model_kwargs in tqdm(model_runs.items()):

s_pred_ts = get_model_pred_ts(**model_kwargs)

s_err = s_pred_ts - s_price.loc[s_pred_ts.index]

metrics = calc_error_metrics(s_err)

model_outputs[model_name] = {

's_pred_ts': s_pred_ts,

's_err': s_err,

'metrics': metrics

}

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\pandas\core\indexes\base.py:5277: FutureWarning: Indexing a timezone-aware DatetimeIndex with a timezone-naive datetime is deprecated and will raise KeyError in a future version. Use a timezone-aware object instead.

start_slice, end_slice = self.slice_locs(start, end, step=step, kind=kind)

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\pandas\core\indexes\base.py:5277: FutureWarning: Indexing a timezone-aware DatetimeIndex with a timezone-naive datetime is deprecated and will raise KeyError in a future version. Use a timezone-aware object instead.

start_slice, end_slice = self.slice_locs(start, end, step=step, kind=kind)

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\pandas\core\indexes\base.py:5277: FutureWarning: Indexing a timezone-aware DatetimeIndex with a timezone-naive datetime is deprecated and will raise KeyError in a future version. Use a timezone-aware object instead.

start_slice, end_slice = self.slice_locs(start, end, step=step, kind=kind)

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\pandas\core\indexes\base.py:5277: FutureWarning: Indexing a timezone-aware DatetimeIndex with a timezone-naive datetime is deprecated and will raise KeyError in a future version. Use a timezone-aware object instead.

start_slice, end_slice = self.slice_locs(start, end, step=step, kind=kind)

Overall, the dispatch model fitted to the median price appears to be the most accurate

df_metrics = pd.DataFrame({

name: outputs['metrics']

for name, outputs

in model_outputs.items()

})

df_metrics

| Unnamed: 0 | demand_p50 | demand_avg | dispatch_p50 | dispatch_avg |

|---|---|---|---|---|

| median_abs_err | 4.70534 | 5.04971 | 4.47311 | 4.77768 |

| mean_abs_err | 6.97489 | 7.09014 | 6.55688 | 6.6518 |

| root_mean_square_error | 12.6323 | 12.41 | 12.0539 | 11.8075 |

We'll quantify the difference against the standard LOWESS approach

old_err = df_metrics.loc['mean_abs_err', 'dispatch_avg']

new_err = df_metrics.loc['mean_abs_err', 'dispatch_p50']

print(f'{-100*(new_err - old_err)/old_err:.2f}% mean absolute error reduction using the p50 model rather than the average model')

1.43% mean absolute error reduction using the p50 model rather than the average model

And also look at the improvement in accuracy when regressing against dispatchable generation instead of total generation

old_err = df_metrics.loc['mean_abs_err', 'demand_avg']

new_err = df_metrics.loc['mean_abs_err', 'dispatch_avg']

print(f'{-100*(new_err - old_err)/old_err:.2f}% mean absolute error reduction using the dispatchable demand model rather than just demand')

6.18% mean absolute error reduction using the dispatchable demand model rather than just demand

Quantifying & Visualising the Merit Order Effect¶

To begin we'll load up our dispatchable supply model and make an inference for each half-hour in the dataset, based on the results in the previous section we'll use the p50 model.

%%time

s_GB_demand = df_EI_model['demand']

s_GB_price = df_EI_model['day_ahead_price']

s_GB_dispatchable = df_EI_model['demand'] - df_EI_model[['solar', 'wind']].sum(axis=1)

s_GB_pred_ts_dispatch, s_GB_pred_ts_demand = get_model_pred_ts(s_GB_dispatchable, GB_model_fp, s_demand=s_GB_demand)

s_dispatch_GB_err = s_GB_pred_ts_dispatch - s_GB_price.loc[s_GB_pred_ts_dispatch.index]

GB_dispatch_metrics = calc_error_metrics(s_dispatch_GB_err)

s_demand_GB_err = s_GB_pred_ts_demand - s_GB_price.loc[s_GB_pred_ts_demand.index]

GB_demand_metrics = calc_error_metrics(s_demand_GB_err)

s_GB_pred_ts_dispatch

Wall time: 92.1 ms

local_datetime

2009-01-01 00:00:00+00:00 37.203441

2009-01-01 00:30:00+00:00 37.313379

2009-01-01 01:00:00+00:00 36.768513

2009-01-01 01:30:00+00:00 35.595162

2009-01-01 02:00:00+00:00 34.849422

...

2020-12-30 21:30:00+00:00 48.066638

2020-12-30 22:00:00+00:00 45.268069

2020-12-30 22:30:00+00:00 42.647597

2020-12-30 23:00:00+00:00 39.520118

2020-12-30 23:30:00+00:00 37.948852

Length: 209533, dtype: float64

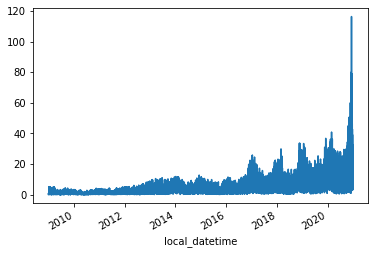

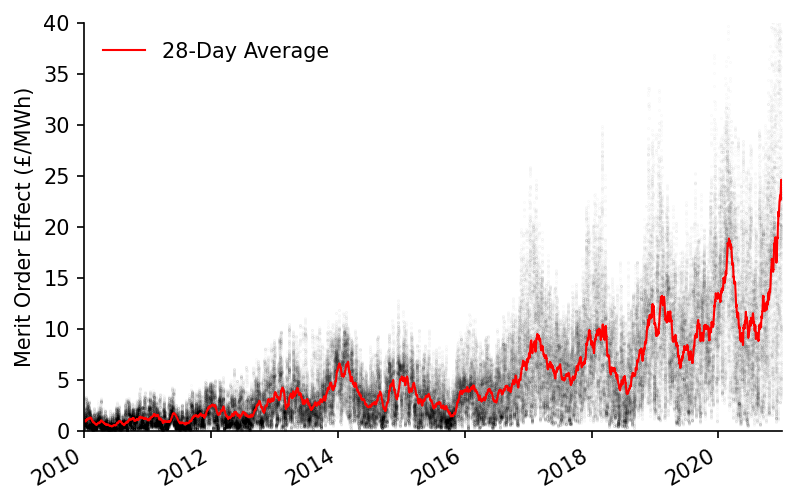

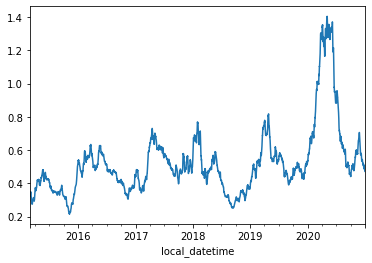

The difference between the price forecast when using the dispatchable generation and total generation is due to the merit order effect

s_GB_MOE = s_GB_pred_ts_demand - s_GB_pred_ts_dispatch

s_GB_MOE = s_GB_MOE.dropna()

s_GB_MOE.plot()

<AxesSubplot:xlabel='local_datetime'>

We'll quickly calculate the averages for 2010 and 2020

s_GB_MOE['2010'].mean(), s_GB_MOE['2020'].mean()

(0.8813580281178922, 13.888630517942211)

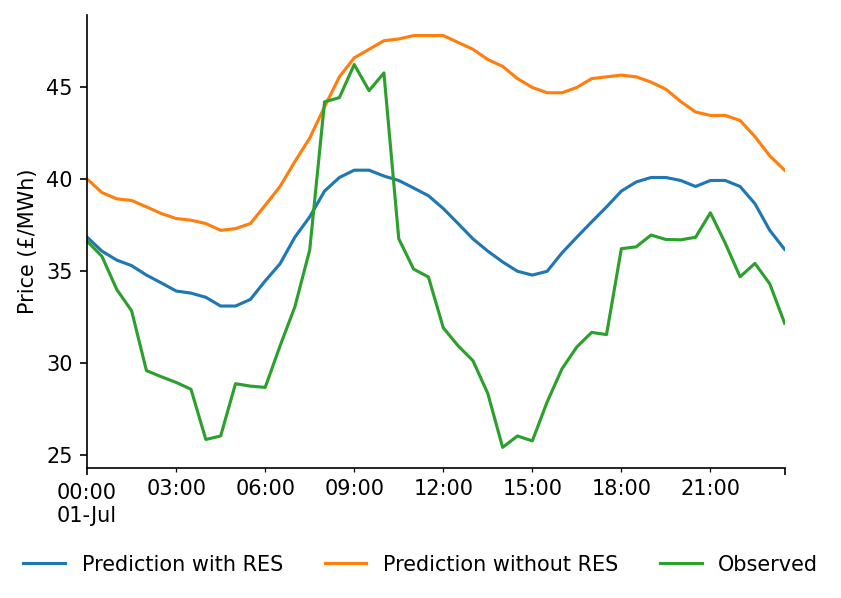

We'll also visualise the predictions for a sample day

date = '2017-07-01'

# Plotting

fig, ax = plt.subplots(dpi=150)

s_GB_pred_ts_dispatch[date].plot(label='Prediction with RES', ax=ax)

s_GB_pred_ts_demand[date].plot(label='Prediction without RES', ax=ax)

s_GB_price[date].plot(label='Observed', ax=ax)

ax.legend(frameon=False, ncol=3, bbox_to_anchor=(1.075, -0.15))

ax.set_xlabel('')

ax.set_ylabel('Price (£/MWh)')

eda.hide_spines(ax)

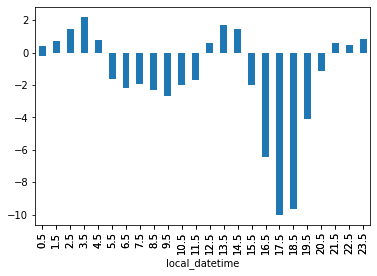

We can see that there is a clear pattern in the bias over the course of the day

s_GB_err.groupby(s_GB_err.index.hour+s_GB_err.index.minute/60).mean().plot.bar()

<AxesSubplot:xlabel='local_datetime'>

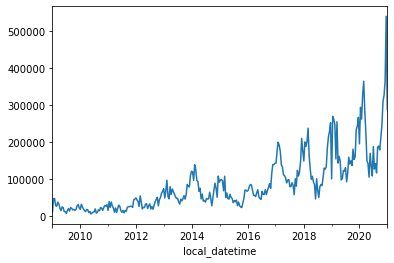

We'll now calculate the half-hourly savings due to the merit order effect. The demand is expressed in terms of GW which we'll convert into MWh to be compatible with the units of the merit order effect.

s_GB_saving = s_GB_MOE * s_GB_demand.loc[s_GB_MOE.index]*1000*0.5

s_GB_saving.resample('2W').mean().plot()

<AxesSubplot:xlabel='local_datetime'>

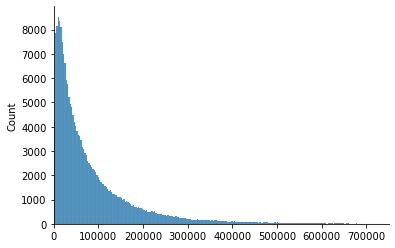

The distribution of the price savings appears to follow a rough Pareto distribution

sns.histplot(s_GB_saving)

plt.xlim(0, 750000)

eda.hide_spines(plt.gca())

We'll calculate the total savings over the dataset period

start_date = '2010'

end_date = '2020'

total_saving = s_GB_saving[start_date:end_date].sum()

print(f"The total saving between {start_date} and {end_date} was £{total_saving:,.0f}")

The total saving between 2010 and 2020 was £17,454,468,143

To add some context we'll calculate the average half-hourly market volume (note that the DAM volume will be smaller than demand but it acts as a good proxy to cover all markets)

s_mkt_cost = df_EI['day_ahead_price']*df_EI['demand']*1000*0.5

avg_HH_mkt_cost = s_mkt_cost.mean()

avg_HH_mkt_cost

784440.8559554707

We'll also calculate the long-term price reduction due to the merit order effect

s_GB_MOE[start_date:end_date].mean()/(df_EI['day_ahead_price']+s_GB_MOE)[start_date:end_date].mean()

0.15034496268274428

This only tells part of the story though, lets look at how this value evolves over time

s_GB_DAM = s_GB_price.loc[s_GB_MOE.index]

s_GB_MOE_rolling = s_GB_MOE.rolling(48*28).mean().dropna()

s_GB_DAM_rolling = s_GB_DAM.rolling(48*28).mean().dropna()

s_GB_MOE_pct_reduction = s_GB_MOE_rolling/s_GB_DAM_rolling

s_GB_MOE_pct_reduction.plot()

<AxesSubplot:xlabel='local_datetime'>

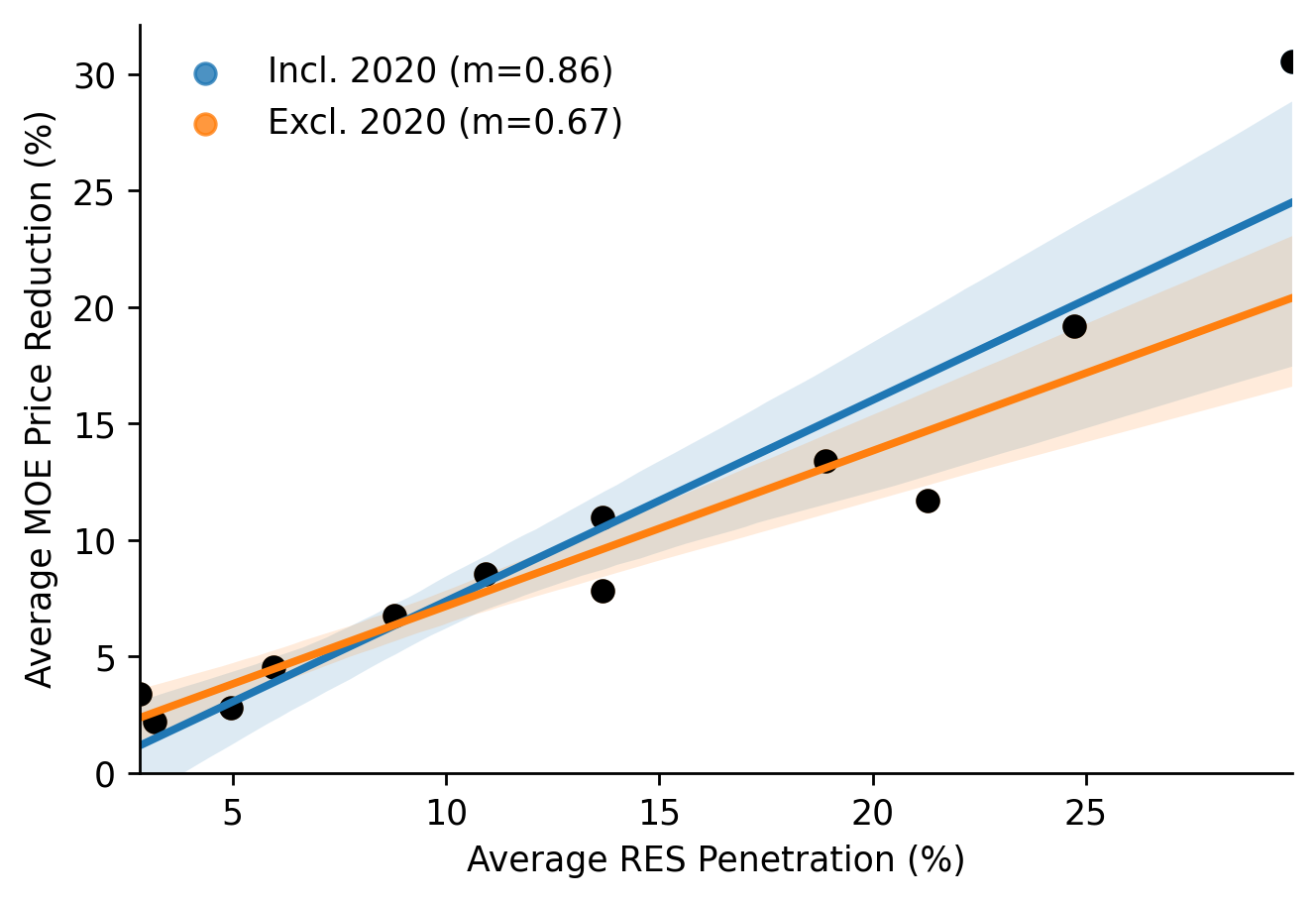

We're half-way to creating the metrics required for comparing between markets of different sizes, prices and RES penetration. We'll calculate the renewables penetration percentage and then aggregate it on an annual basis alongside the pct price reduction due to the MOE.

%%time

s_GB_MOE_pct_annual_avg = (s_GB_MOE/(df_EI.loc[s_GB_MOE.index]['day_ahead_price']+s_GB_MOE)).replace(np.inf, np.nan).dropna().pipe(lambda s: s.groupby(s.index.year).mean())

s_GB_RES_pct_annual_avg = (df_EI[['wind', 'solar']].sum(axis=1)/df_EI['demand']).pipe(lambda s: s.groupby(s.index.year).mean())

# Plotting

fig, ax = plt.subplots(dpi=250)

sns.regplot(x=100*s_GB_RES_pct_annual_avg, y=100*s_GB_MOE_pct_annual_avg, ax=ax, label='Incl. 2020 (m=0.86)')

sns.regplot(x=100*s_GB_RES_pct_annual_avg.loc[:2019], y=100*s_GB_MOE_pct_annual_avg.loc[:2019], truncate=False, ax=ax, label='Excl. 2020 (m=0.67)')

ax.scatter(x=100*s_GB_RES_pct_annual_avg, y=100*s_GB_MOE_pct_annual_avg, color='k')

eda.hide_spines(ax)

ax.legend(frameon=False, loc='upper left')

ax.set_ylim(0)

ax.set_xlabel('Average RES Penetration (%)')

ax.set_ylabel('Average MOE Price Reduction (%)')

Wall time: 753 ms

Text(0, 0.5, 'Average MOE Price Reduction (%)')

We'll fit a linear regression that includes 2020

linreg_results = scipy.stats.linregress(x=s_GB_RES_pct_annual_avg, y=s_GB_MOE_pct_annual_avg)

linreg_results

LinregressResult(slope=0.8635390661954275, intercept=-0.01260770809733558, rvalue=0.9407770535093302, pvalue=5.192107447861512e-06, stderr=0.0984074783808127, intercept_stderr=0.01545140550162944)

And one that excludes 2020

max_year = 2019

linreg_results = scipy.stats.linregress(x=s_GB_RES_pct_annual_avg.loc[:max_year], y=s_GB_MOE_pct_annual_avg.loc[:max_year])

linreg_results

LinregressResult(slope=0.6675133238057994, intercept=0.004850800918389769, rvalue=0.9588281998847612, pvalue=3.215977627236812e-06, stderr=0.06590160431497857, intercept_stderr=0.009037033037260158)

We'll also visualise the how the MOE time-series and trend

fig, ax = plt.subplots(dpi=150)

ax.scatter(s_GB_MOE.index, s_GB_MOE, s=0.01, alpha=0.1, color='k', label=None)

s_GB_MOE_rolling.plot(color='r', linewidth=1, ax=ax, label='28-Day Average')

eda.hide_spines(ax)

ax.set_ylim(0, 40)

ax.set_xlim(pd.to_datetime('2010'), pd.to_datetime('2021'))

ax.set_xlabel('')

ax.set_ylabel('Merit Order Effect (£/MWh)')

ax.legend(frameon=False)

<matplotlib.legend.Legend at 0x22ccd2776d0>

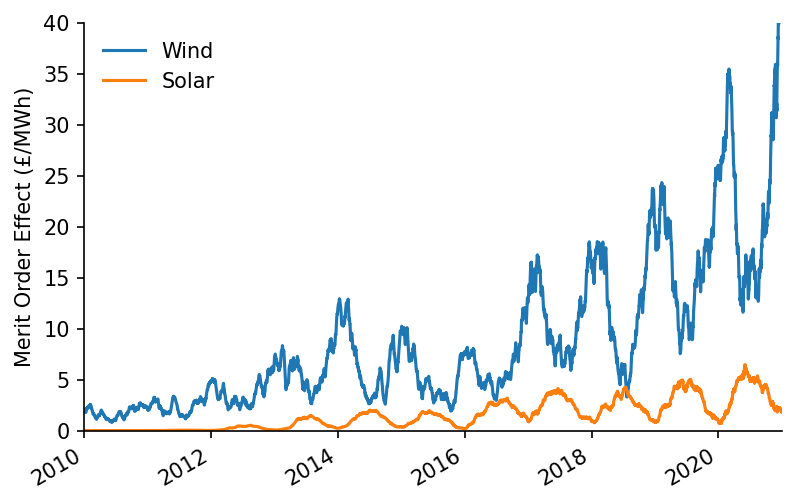

We can also attribute specific savings from the MOE to the different RES technologies

wind_weight = df_EI.loc[s_GB_MOE.index, 'wind']/df_EI.loc[s_GB_MOE.index][['wind', 'solar']].mean(axis=1)

solar_weight = df_EI.loc[s_GB_MOE.index, 'solar']/df_EI.loc[s_GB_MOE.index][['wind', 'solar']].mean(axis=1)

s_wind_MOE = s_GB_MOE*wind_weight

s_solar_MOE = s_GB_MOE*solar_weight

# Plotting

fig, ax = plt.subplots(dpi=150)

s_wind_MOE.rolling(48*28).mean().plot(ax=ax, label='Wind')

s_solar_MOE.rolling(48*28).mean().plot(ax=ax, label='Solar')

ax.set_ylim(0, 40)

ax.set_xlim(pd.to_datetime('2010'), pd.to_datetime('2021'))

ax.set_xlabel('')

ax.set_ylabel('Merit Order Effect (£/MWh)')

ax.legend(frameon=False)

eda.hide_spines(ax)

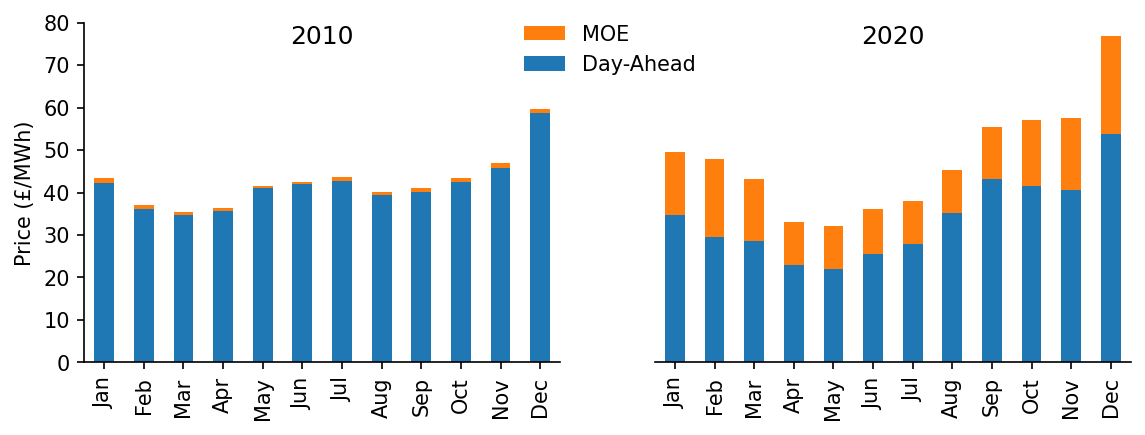

To add some context we'll plot the MOE alongside the actual price, we'll also do this for both years at the extremes of the dataset time range

year_1 = '2010'

year_2 = '2020'

month_num_to_name = dict(zip(np.arange(1, 13), pd.date_range('2010-01-01', '2010-12-31', freq='M').strftime('%b')))

s_hourly_dam_10 = s_GB_DAM[year_1].groupby(s_GB_DAM[year_1].index.month).mean()

s_hourly_MOE_10 = s_GB_MOE[year_1].groupby(s_GB_MOE[year_1].index.month).mean()

s_hourly_dam_20 = s_GB_DAM[year_2].groupby(s_GB_DAM[year_2].index.month).mean()

s_hourly_MOE_20 = s_GB_MOE[year_2].groupby(s_GB_MOE[year_2].index.month).mean()

for s in [s_hourly_dam_10, s_hourly_MOE_10, s_hourly_dam_20, s_hourly_MOE_20]:

s.index = s.index.map(month_num_to_name)

# Plotting

fig, axs = plt.subplots(dpi=150, ncols=2, figsize=(9, 3))

(s_hourly_dam_10+s_hourly_MOE_10).plot.bar(color='C1', label='MOE', ax=axs[0])

s_hourly_dam_10.plot.bar(label='Price', ax=axs[0])

(s_hourly_dam_20+s_hourly_MOE_20).plot.bar(color='C1', label='MOE', ax=axs[1])

s_hourly_dam_20.plot.bar(label='Day-Ahead', ax=axs[1])

axs[0].set_title(year_1, y=0.9)

axs[1].set_title(year_2, y=0.9)

for ax in axs:

eda.hide_spines(ax)

ax.set_ylim(0, 80)

ax.set_xlabel('')

axs[1].legend(frameon=False, bbox_to_anchor=(0.125, 1.05))

axs[1].set_yticks([])

eda.hide_spines(axs[1], positions=['left'])

axs[0].set_ylabel('Price (£/MWh)')

Text(0, 0.5, 'Price (£/MWh)')

We'll create a combined dataframe of the predicted and observed time-series

df_GB_results_ts = pd.DataFrame({

'prediction': s_GB_pred_ts_dispatch,

'counterfactual': s_GB_pred_ts_demand,

'observed': s_GB_price,

'moe': s_GB_MOE

})

df_GB_results_ts.head()

| local_datetime | prediction | counterfactual | observed | moe |

|---|---|---|---|---|

| 2009-01-01 00:00:00+00:00 | 37.2034 | 37.3134 | 58.05 | 0.109938 |

| 2009-01-01 00:30:00+00:00 | 37.3134 | 37.5351 | 56.33 | 0.221756 |

| 2009-01-01 01:00:00+00:00 | 36.7685 | 36.9851 | 52.98 | 0.216574 |

| 2009-01-01 01:30:00+00:00 | 35.5952 | 35.8076 | 50.39 | 0.212469 |

| 2009-01-01 02:00:00+00:00 | 34.8494 | 35.0631 | 48.7 | 0.213697 |

Which we'll then save as a csv

df_GB_results_ts.to_csv('../data/results/GB_price.csv')

Wind Capture-Value Ratio¶

Now we'll turn our focus to calculating the capture-value ratio of wind over time

s_wind = df_EI[['day_ahead_price', 'wind']].dropna()['wind']

s_dam = df_EI[['day_ahead_price', 'wind']].dropna()['day_ahead_price']

We'll do this by weighting the price time-series using the wind generation data

#exports

def weighted_mean_s(s, s_weight=None, dt_rng=pd.date_range('2009-12-01', '2021-01-01', freq='W'), end_dt_delta_days=7):

"""Calculates the weighted average of a series"""

capture_prices = dict()

for start_dt in dt_rng:

end_dt = start_dt + pd.Timedelta(days=end_dt_delta_days)

if s_weight is not None:

weights = s_weight[start_dt:end_dt]

else:

weights=None

capture_prices[start_dt] = np.average(s[start_dt:end_dt], weights=weights)

s_capture_prices = pd.Series(capture_prices)

s_capture_prices.index = pd.to_datetime(s_capture_prices.index)

return s_capture_prices

s_wind_capture_prices = weighted_mean_s(s_dam, s_wind)

s_dam_prices = weighted_mean_s(s_dam)

s_wind_capture_prices.plot()

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\pandas\core\indexes\base.py:5277: FutureWarning: Indexing a timezone-aware DatetimeIndex with a timezone-naive datetime is deprecated and will raise KeyError in a future version. Use a timezone-aware object instead.

start_slice, end_slice = self.slice_locs(start, end, step=step, kind=kind)

<AxesSubplot:>

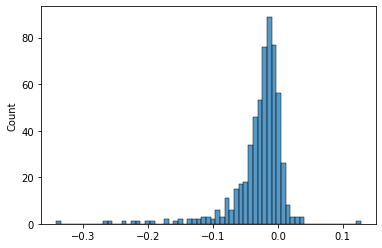

We'll look at the distribution of the wind capture value ratio

s_wind_capture_value_ratio = (s_wind_capture_prices - s_dam_prices)/s_dam_prices

print(round(s_wind_capture_value_ratio.mean(), 4))

sns.histplot(s_wind_capture_value_ratio)

-0.028

<AxesSubplot:ylabel='Count'>

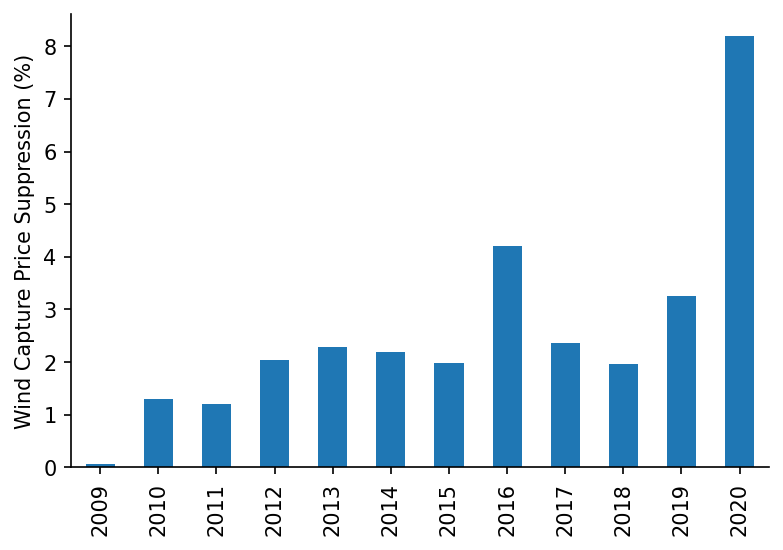

We'll look at how this has changed on an annual basis

fig, ax = plt.subplots(dpi=150)

(-100*s_wind_capture_value_ratio.groupby(s_wind_capture_value_ratio.index.year).mean()).plot.bar(ax=ax)

eda.hide_spines(ax)

ax.set_ylabel('Wind Capture Price Suppression (%)')

Text(0, 0.5, 'Wind Capture Price Suppression (%)')

It could be interesting to look at the effect of price suppression on specific wind farms that have CfDs, and then estimate the increased burden on the tax-payer.

German Model¶

We'll now repeat the price MOE calculations for Germany, starting by loading in the relevant data

%%time

df_DE = eda.load_DE_df('../data/raw/energy_charts.csv', '../data/raw/ENTSOE_DE_price.csv')

df_DE.head()

Wall time: 2.29 s

| local_datetime | Biomass | Brown Coal | Gas | Hard Coal | Hydro Power | Oil | Others | Pumped Storage | Seasonal Storage | Solar | Uranium | Wind | net_balance | demand | price |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010-01-03 23:00:00+00:00 | 3.637 | 16.533 | 4.726 | 10.078 | 2.331 | 0 | 0 | 0.052 | 0.068 | 0 | 16.826 | 0.635 | -1.229 | 53.657 | nan |

| 2010-01-04 00:00:00+00:00 | 3.637 | 16.544 | 4.856 | 8.816 | 2.293 | 0 | 0 | 0.038 | 0.003 | 0 | 16.841 | 0.528 | -1.593 | 51.963 | nan |

| 2010-01-04 01:00:00+00:00 | 3.637 | 16.368 | 5.275 | 7.954 | 2.299 | 0 | 0 | 0.032 | 0 | 0 | 16.846 | 0.616 | -1.378 | 51.649 | nan |

| 2010-01-04 02:00:00+00:00 | 3.637 | 15.837 | 5.354 | 7.681 | 2.299 | 0 | 0 | 0.027 | 0 | 0 | 16.699 | 0.63 | -1.624 | 50.54 | nan |

| 2010-01-04 03:00:00+00:00 | 3.637 | 15.452 | 5.918 | 7.498 | 2.301 | 0.003 | 0 | 0.02 | 0 | 0 | 16.635 | 0.713 | -0.731 | 51.446 | nan |

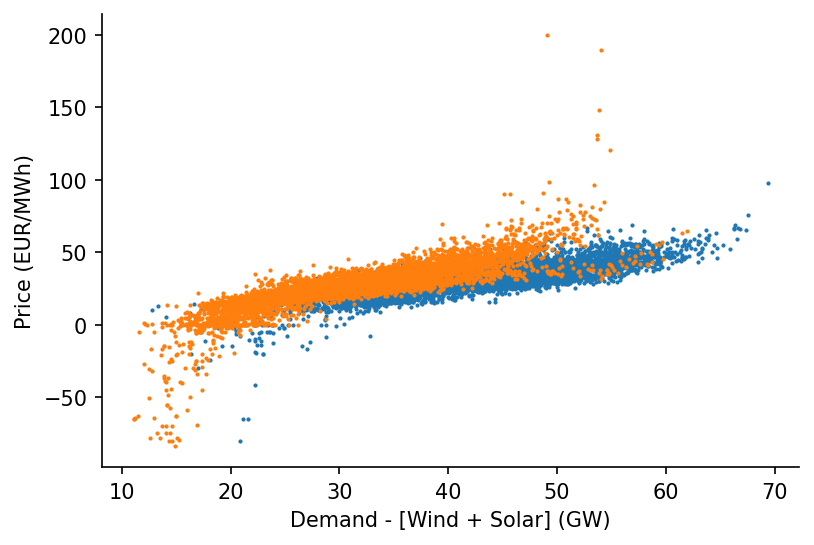

We'll clean up the data and do a quick plot

df_DE_model = df_DE[['price', 'demand', 'Solar', 'Wind']].dropna()

s_DE_price = df_DE_model['price']

s_DE_demand = df_DE_model['demand']

s_DE_dispatchable = df_DE_model['demand'] - df_DE_model[['Solar', 'Wind']].sum(axis=1)

# Plotting

fig, ax = plt.subplots(dpi=150)

ax.scatter(s_DE_dispatchable['2015-03':'2015-09'], s_DE_price['2015-03':'2015-09'], s=1)

ax.scatter(s_DE_dispatchable['2020-03':'2020-09'], s_DE_price['2020-03':'2020-09'], s=1)

eda.hide_spines(ax)

ax.set_xlabel('Demand - [Wind + Solar] (GW)')

ax.set_ylabel('Price (EUR/MWh)')

Text(0, 0.5, 'Price (EUR/MWh)')

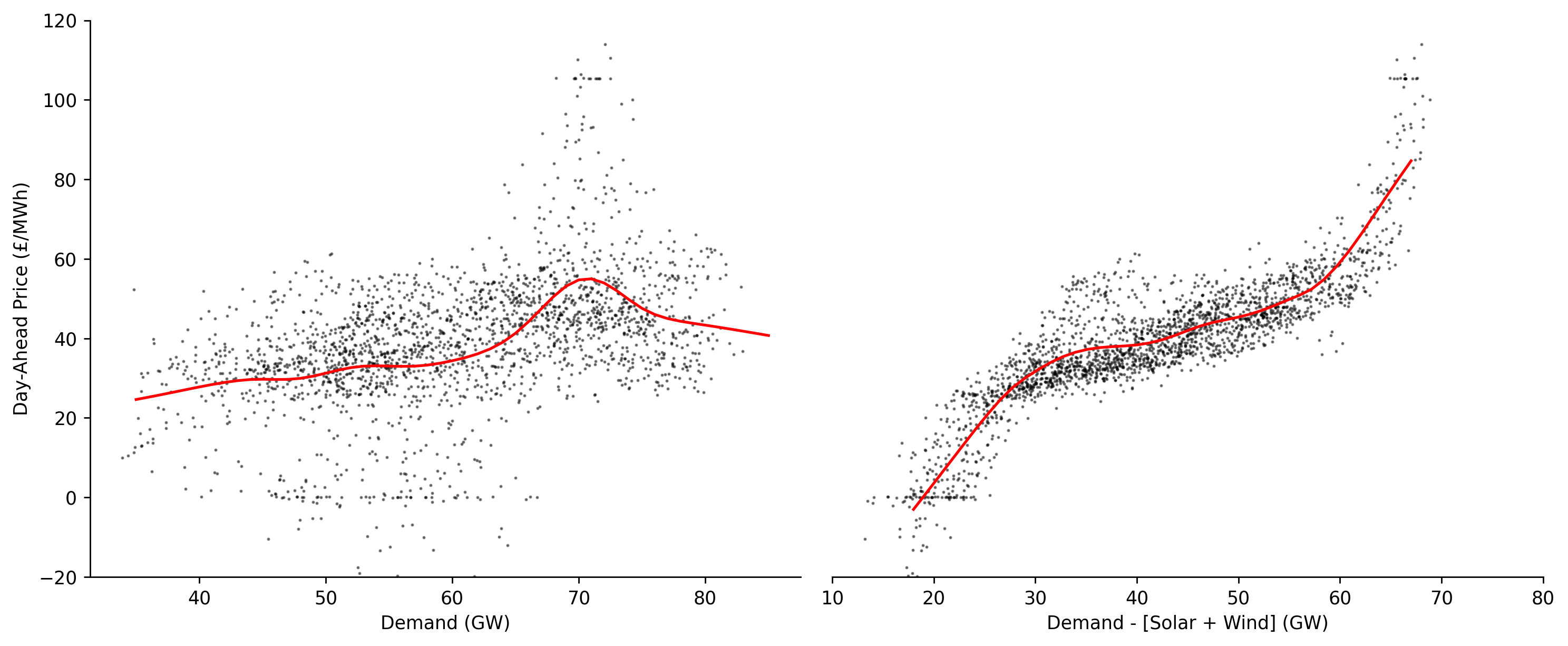

Let's create a visualisation that highlights the importance of regressing against dispatchable instead of total load

%%time

dt_min = '2020-10'

dt_max = '2020-12'

# Dispatchable

x_dispatch = s_DE_dispatchable[dt_min:dt_max].values

y_dispatch = s_DE_price.loc[s_DE_dispatchable.index][dt_min:dt_max].values

x_pred_dispatch = np.linspace(18, 67, 41)

y_pred_dispatch = lowess.lowess_fit_and_predict(x_dispatch, y_dispatch, frac=0.25, num_fits=50, x_pred=x_pred_dispatch)

# Demand

x_demand = s_DE_demand[dt_min:dt_max].values

y_demand = s_DE_price.loc[s_DE_dispatchable.index][dt_min:dt_max].values

x_pred_demand = np.linspace(35, 85, 51)

y_pred_demand = lowess.lowess_fit_and_predict(x_demand, y_demand, frac=0.25, num_fits=50, x_pred=x_pred_demand)

# Plotting

fig, axs = plt.subplots(dpi=250, ncols=2, figsize=(12, 5))

ax = axs[0]

ax.plot(x_pred_demand, y_pred_demand, linewidth=1.5, color='r')

ax.scatter(x_demand, y_demand, color='k', s=0.5, alpha=0.5)

eda.hide_spines(ax)

ax.set_xlabel('Demand (GW)')

ax.set_ylabel('Day-Ahead Price (£/MWh)')

ax = axs[1]

ax.plot(x_pred_dispatch, y_pred_dispatch, linewidth=1.5, color='r')

ax.scatter(x_dispatch, y_dispatch, color='k', s=0.5, alpha=0.5)

ax.set_xlim(10, 80)

eda.hide_spines(ax, positions=['top', 'left', 'right'])

ax.set_yticks([])

ax.set_xlabel('Demand - [Solar + Wind] (GW)')

for ax in axs:

ax.set_ylim(-20, 120)

fig.tight_layout()

Wall time: 236 ms

We'll load in our model

%%time

if load_existing_DE_model == True:

smooth_dates = pickle.load(open(DE_model_fp, 'rb'))

else:

reg_dates = pd.date_range('2015-01-01', '2021-01-01', freq='13W')

smooth_dates = lowess.SmoothDates()

smooth_dates.fit(s_DE_dispatchable.values, s_DE_price.values, dt_idx=s_DE_dispatchable.index,

reg_dates=reg_dates, frac=0.3, num_fits=31, threshold_value=26)

pickle.dump(smooth_dates, open(model_fp, 'wb'))

Wall time: 364 ms

Generate the regression surface prediction

%%time

x_pred = np.linspace(-5, 90, 951)

dt_pred = pd.date_range('2015-01-01', '2020-12-31', freq='1D')

df_DE_pred = smooth_dates.predict(x_pred=x_pred, dt_pred=dt_pred)

df_DE_pred.index = np.round(df_DE_pred.index, 1)

df_DE_pred.head()

Wall time: 276 ms

| Unnamed: 0 | 2015-01-01 | 2015-01-02 | 2015-01-03 | 2015-01-04 | 2015-01-05 | 2015-01-06 | 2015-01-07 | 2015-01-08 | 2015-01-09 | 2015-01-10 | ... | 2020-12-22 | 2020-12-23 | 2020-12-24 | 2020-12-25 | 2020-12-26 | 2020-12-27 | 2020-12-28 | 2020-12-29 | 2020-12-30 | 2020-12-31 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| -5 | -38.4761 | -38.4242 | -38.3727 | -38.3215 | -38.2708 | -38.2205 | -38.1705 | -38.1208 | -38.0715 | -38.0225 | ... | -48.2642 | -48.2766 | -48.289 | -48.3016 | -48.3144 | -48.3272 | -48.3402 | -48.3534 | -48.3667 | -48.3801 |

| -4.9 | -38.3167 | -38.2649 | -38.2136 | -38.1626 | -38.112 | -38.0618 | -38.012 | -37.9625 | -37.9133 | -37.8644 | ... | -48.0285 | -48.0407 | -48.0531 | -48.0657 | -48.0783 | -48.0911 | -48.104 | -48.1171 | -48.1304 | -48.1437 |

| -4.8 | -38.1572 | -38.1056 | -38.0544 | -38.0036 | -37.9532 | -37.9031 | -37.8534 | -37.8041 | -37.7551 | -37.7064 | ... | -47.7926 | -47.8048 | -47.8172 | -47.8296 | -47.8422 | -47.8549 | -47.8678 | -47.8808 | -47.894 | -47.9073 |

| -4.7 | -37.9977 | -37.9463 | -37.8952 | -37.8446 | -37.7943 | -37.7444 | -37.6949 | -37.6457 | -37.5968 | -37.5482 | ... | -47.5568 | -47.5689 | -47.5812 | -47.5936 | -47.6061 | -47.6188 | -47.6316 | -47.6445 | -47.6576 | -47.6709 |

| -4.6 | -37.8382 | -37.7869 | -37.736 | -37.6855 | -37.6354 | -37.5857 | -37.5363 | -37.4872 | -37.4385 | -37.3901 | ... | -47.3209 | -47.333 | -47.3452 | -47.3575 | -47.3699 | -47.3825 | -47.3953 | -47.4082 | -47.4212 | -47.4344 |

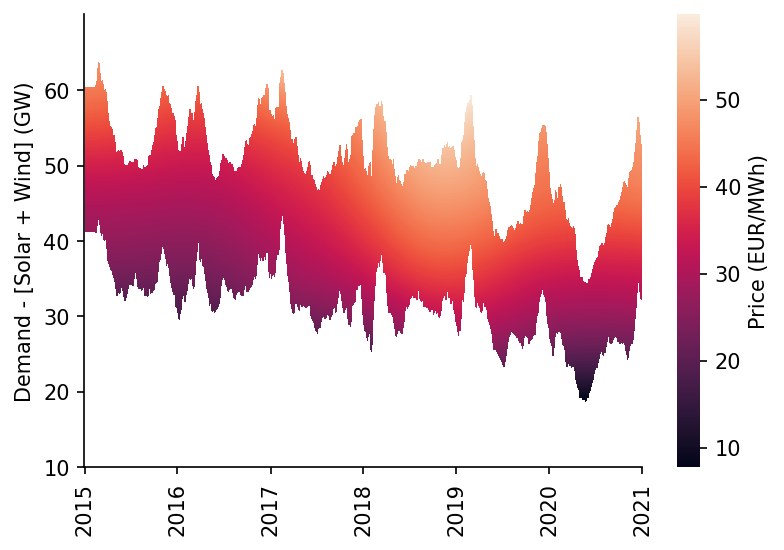

As with the GB market you can see what is likely the effect of higher gas prices in 2018

df_DE_dispatchable_lims = construct_dispatchable_lims_df(s_DE_dispatchable, rolling_w=6)

df_DE_pred_mask = construct_pred_mask_df(df_DE_pred, df_DE_dispatchable_lims)

# Plotting

min_y = 10

max_y = 70

fig, ax = plt.subplots(dpi=150)

htmp = sns.heatmap(df_DE_pred[min_y:max_y].where(df_DE_pred_mask[min_y:max_y], np.nan).iloc[::-1], ax=ax, cbar_kws={'label': 'Price (EUR/MWh)'})

set_ticks(ax, np.arange(min_y, max_y, 10), axis='y')

set_date_ticks(ax, '2015-01-01', '2021-01-01', freq='1YS', date_format='%Y', axis='x')

for _, spine in htmp.spines.items():

spine.set_visible(True)

eda.hide_spines(ax)

ax.set_ylabel('Demand - [Solar + Wind] (GW)')

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\sklearn\utils\validation.py:63: FutureWarning: Arrays of bytes/strings is being converted to decimal numbers if dtype='numeric'. This behavior is deprecated in 0.24 and will be removed in 1.1 (renaming of 0.26). Please convert your data to numeric values explicitly instead.

return f(*args, **kwargs)

Text(69.58333333333334, 0.5, 'Demand - [Solar + Wind] (GW)')

We'll calculate some metrics for our model

s_DE_pred_ts_dispatch, s_DE_pred_ts_demand = get_model_pred_ts(s_DE_dispatchable, DE_model_fp, s_demand=s_DE_demand, x_pred=x_pred, dt_pred=dt_pred)

s_DE_dispatch_err = s_DE_pred_ts_dispatch - s_DE_price.loc[s_DE_pred_ts_dispatch.index]

DE_dispatch_metrics = calc_error_metrics(s_DE_dispatch_err)

s_DE_demand_err = s_DE_pred_ts_demand - s_DE_price.loc[s_DE_pred_ts_demand.index]

DE_demand_metrics = calc_error_metrics(s_DE_demand_err)

DE_dispatch_metrics

{'median_abs_err': 4.257075090332123,

'mean_abs_err': 5.852023979176648,

'root_mean_square_error': 8.705711313706535}

As well as the \(r^{2}\) score

# 0.733 for Halttunen2021

r2_score(s_DE_price.loc[s_DE_pred_ts_dispatch.index], s_DE_pred_ts_dispatch)

0.7244797152665161

We'll now calculate the total savings

start_date = '2015'

end_date = '2020'

s_DE_MOE = s_DE_pred_ts_demand - s_DE_pred_ts_dispatch

s_DE_MOE = s_DE_MOE.dropna()

s_DE_saving = s_DE_MOE * df_DE['demand'].loc[s_DE_MOE.index]*1000

total_saving = s_DE_saving[start_date:end_date].sum()

print(f"The total saving between {start_date} and {end_date} was £{total_saving:,.0f}")

The total saving between 2015 and 2020 was £55,856,316,374

And get some context for the market average and total volumes over the same period

s_DE_mkt_cost = df_DE['price']*df_DE['demand']*1000

avg_DE_HH_mkt_cost = s_DE_mkt_cost.mean()

total_DE_mkt_cost = s_DE_mkt_cost[start_date:end_date].sum()

avg_DE_HH_mkt_cost, total_DE_mkt_cost

(2076614.8441243432, 109047198694.6575)

When we plot the percentage MOE over time we can see the large influence of lowered demand in 2020

s_DE_MOE_rolling = s_DE_MOE.rolling(48*28).mean().dropna()

s_DE_DAM_rolling = df_DE.loc[s_DE_MOE.index]['price'].rolling(48*28).mean().dropna()

s_DE_MOE_pct_reduction = s_DE_MOE_rolling/s_DE_DAM_rolling

s_DE_MOE_pct_reduction.plot()

<AxesSubplot:xlabel='local_datetime'>

We'll quickly calculate the average percentage price suppresion

s_DE_MOE[start_date:end_date].mean()/(df_DE['price']+s_DE_MOE)[start_date:end_date].mean()

0.3316044469891089

Of note there appeared to be relatively little impact on the MOE from the effects of the covid-19 response

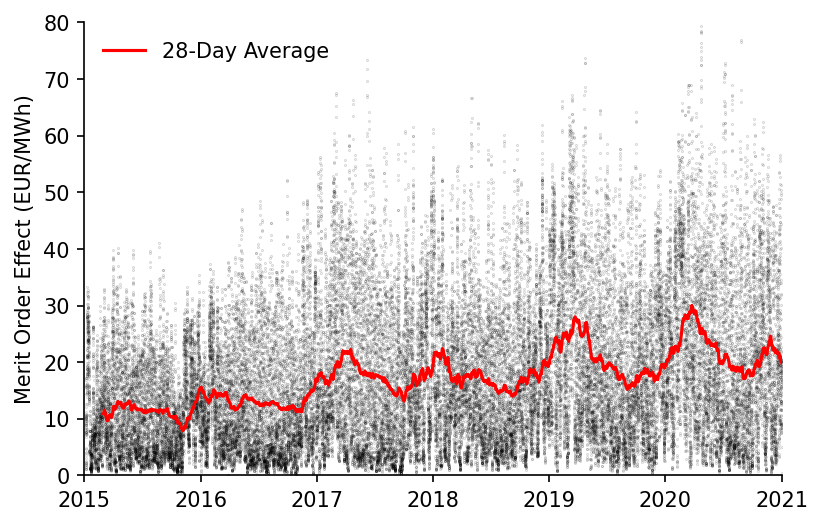

fig, ax = plt.subplots(dpi=150)

ax.scatter(s_DE_MOE.index, s_DE_MOE, s=0.05, alpha=0.3, color='k', label=None)

ax.plot(s_DE_MOE_rolling.index, s_DE_MOE_rolling, color='r', linewidth=1.5, label='28-Day Average')

eda.hide_spines(ax)

ax.set_ylim(0, 80)

ax.set_xlim(pd.to_datetime('2015'), pd.to_datetime('2021'))

ax.set_xlabel('')

ax.set_ylabel('Merit Order Effect (EUR/MWh)')

ax.legend(frameon=False)

<matplotlib.legend.Legend at 0x22ccaf82700>

Interestingly, the forecast made in 2011 by Traber et al as to the German MOE in 2020 was quite close.

"In the absence of expanded deployment of renewable energy, a higher price increase of 20% can be expected" in 2020 - source

s_DE_MOE['2015'].mean(), s_DE_MOE['2020'].mean()

(11.657604746082448, 22.174503965250132)

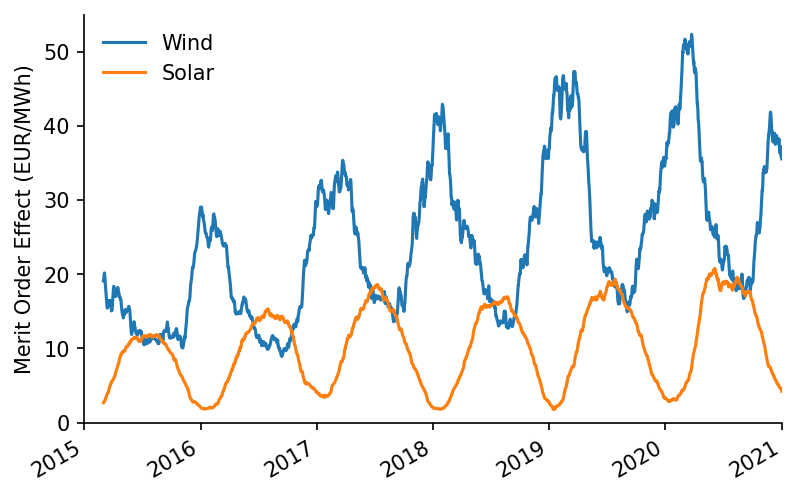

We'll now disaggregate the MOE based on the wind and solar drivers

wind_weight = df_DE.loc[s_DE_MOE.index, 'Wind']/df_DE.loc[s_DE_MOE.index][['Wind', 'Solar']].mean(axis=1)

solar_weight = df_DE.loc[s_DE_MOE.index, 'Solar']/df_DE.loc[s_DE_MOE.index][['Wind', 'Solar']].mean(axis=1)

s_wind_MOE = (s_DE_MOE*wind_weight).dropna()

s_solar_MOE = (s_DE_MOE*solar_weight).dropna()

# Plotting

fig, ax = plt.subplots(dpi=150)

s_wind_MOE.rolling(48*28).mean().plot(ax=ax, label='Wind')

s_solar_MOE.rolling(48*28).mean().plot(ax=ax, label='Solar')

ax.set_ylim(0, 55)

ax.set_xlim(pd.to_datetime('2015'), pd.to_datetime('2021'))

ax.set_xlabel('')

ax.set_ylabel('Merit Order Effect (EUR/MWh)')

ax.legend(frameon=False)

eda.hide_spines(ax)

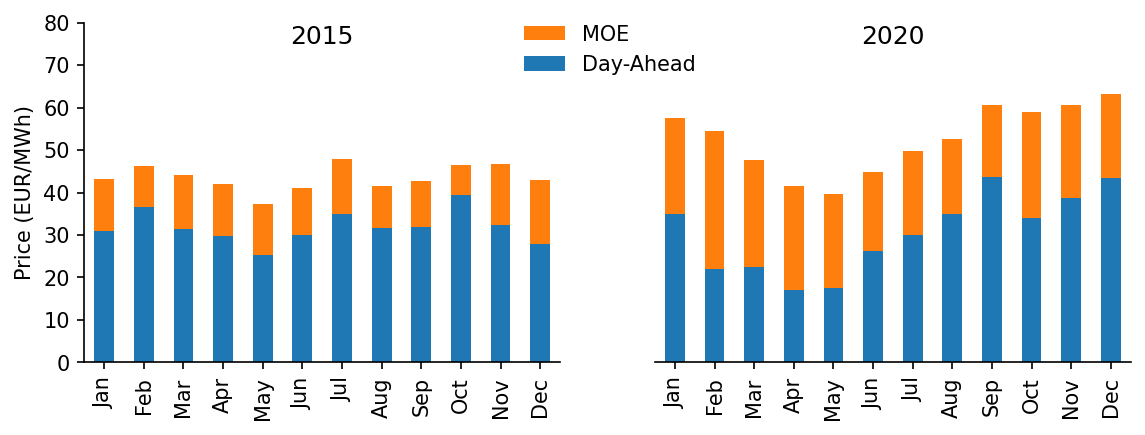

We'll look at how the MOE has changed over time in terms of the seasonal effect

year_1 = '2015'

year_2 = '2020'

s_DE_DAM = df_DE.loc[s_DE_MOE.index, 'price']

month_num_to_name = dict(zip(np.arange(1, 13), pd.date_range('2010-01-01', '2010-12-31', freq='M').strftime('%b')))

s_DE_hourly_dam_10 = s_DE_DAM[year_1].groupby(s_DE_DAM[year_1].index.month).mean()

s_DE_hourly_MOE_10 = s_DE_MOE[year_1].groupby(s_DE_MOE[year_1].index.month).mean()

s_DE_hourly_dam_20 = s_DE_DAM[year_2].groupby(s_DE_DAM[year_2].index.month).mean()

s_DE_hourly_MOE_20 = s_DE_MOE[year_2].groupby(s_DE_MOE[year_2].index.month).mean()

for s in [s_DE_hourly_dam_10, s_DE_hourly_MOE_10, s_DE_hourly_dam_20, s_DE_hourly_MOE_20]:

s.index = s.index.map(month_num_to_name)

# Plotting

fig, axs = plt.subplots(dpi=150, ncols=2, figsize=(9, 3))

(s_DE_hourly_dam_10+s_DE_hourly_MOE_10).plot.bar(color='C1', label='MOE', ax=axs[0])

s_DE_hourly_dam_10.plot.bar(label='Price', ax=axs[0])

(s_DE_hourly_dam_20+s_DE_hourly_MOE_20).plot.bar(color='C1', label='MOE', ax=axs[1])

s_DE_hourly_dam_20.plot.bar(label='Day-Ahead', ax=axs[1])

axs[0].set_title(year_1, y=0.9)

axs[1].set_title(year_2, y=0.9)

for ax in axs:

eda.hide_spines(ax)

ax.set_ylim(0, 80)

ax.set_xlabel('')

axs[1].legend(frameon=False, bbox_to_anchor=(0.125, 1.05))

axs[1].set_yticks([])

eda.hide_spines(axs[1], positions=['left'])

axs[0].set_ylabel('Price (EUR/MWh)')

Text(0, 0.5, 'Price (EUR/MWh)')

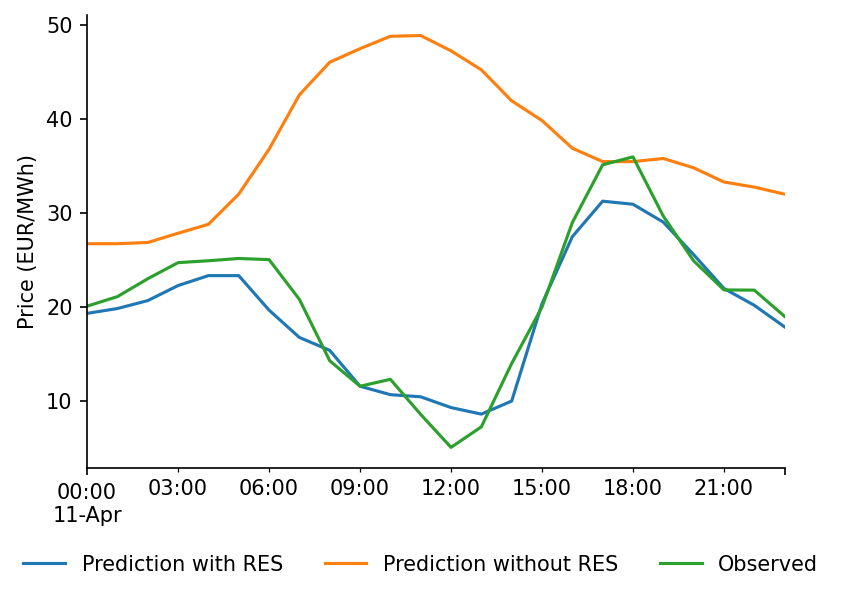

We'll also inspect the predictions on a sample day

date = '2020-04-11'

# Plotting

fig, ax = plt.subplots(dpi=150)

s_DE_pred_ts_dispatch[date].plot(label='Prediction with RES', ax=ax)

s_DE_pred_ts_demand[date].plot(label='Prediction without RES', ax=ax)

s_DE_price[date].plot(label='Observed', ax=ax)

ax.legend(frameon=False, ncol=3, bbox_to_anchor=(1.075, -0.15))

ax.set_xlabel('')

ax.set_ylabel('Price (EUR/MWh)')

eda.hide_spines(ax)

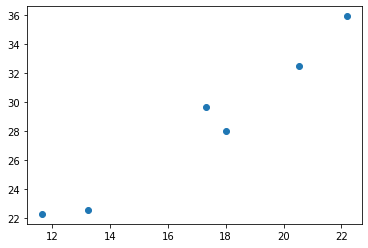

There's clearly a correlation between the annual MOE average and the RES percentage penetration

%%time

s_DE_MOE_annual_avg = s_DE_MOE.replace(np.inf, np.nan).dropna().pipe(lambda s: s.groupby(s.index.year).mean())

s_DE_RES_pct_annual_avg = 100*(df_DE[['Wind', 'Solar']].sum(axis=1)/df_DE['demand']).pipe(lambda s: s.groupby(s.index.year).mean()).loc[2015:].dropna()

plt.scatter(s_DE_MOE_annual_avg, s_DE_RES_pct_annual_avg)

Wall time: 51 ms

<matplotlib.collections.PathCollection at 0x22c405d2dc0>

We'll quickly calculate the gradient

linreg_results = scipy.stats.linregress(x=s_DE_RES_pct_annual_avg, y=s_DE_MOE_annual_avg)

linreg_results

LinregressResult(slope=0.7365449501368756, intercept=-3.832555184231513, rvalue=0.9793888213890273, pvalue=0.0006328529981050964, stderr=0.07595057880689415, intercept_stderr=2.196641338586976)

We'll get some context from the literature

imperial_paper_slope = 0.63

pct_diff = round(100*(linreg_results.slope-imperial_paper_slope)/imperial_paper_slope)

print(f'In this work the MOE increase per percentage penetration of RES was {pct_diff}% higher (for Germany) than the Imperial study')

In this work the MOE increase per percentage penetration of RES was 17% higher (for Germany) than the Imperial study

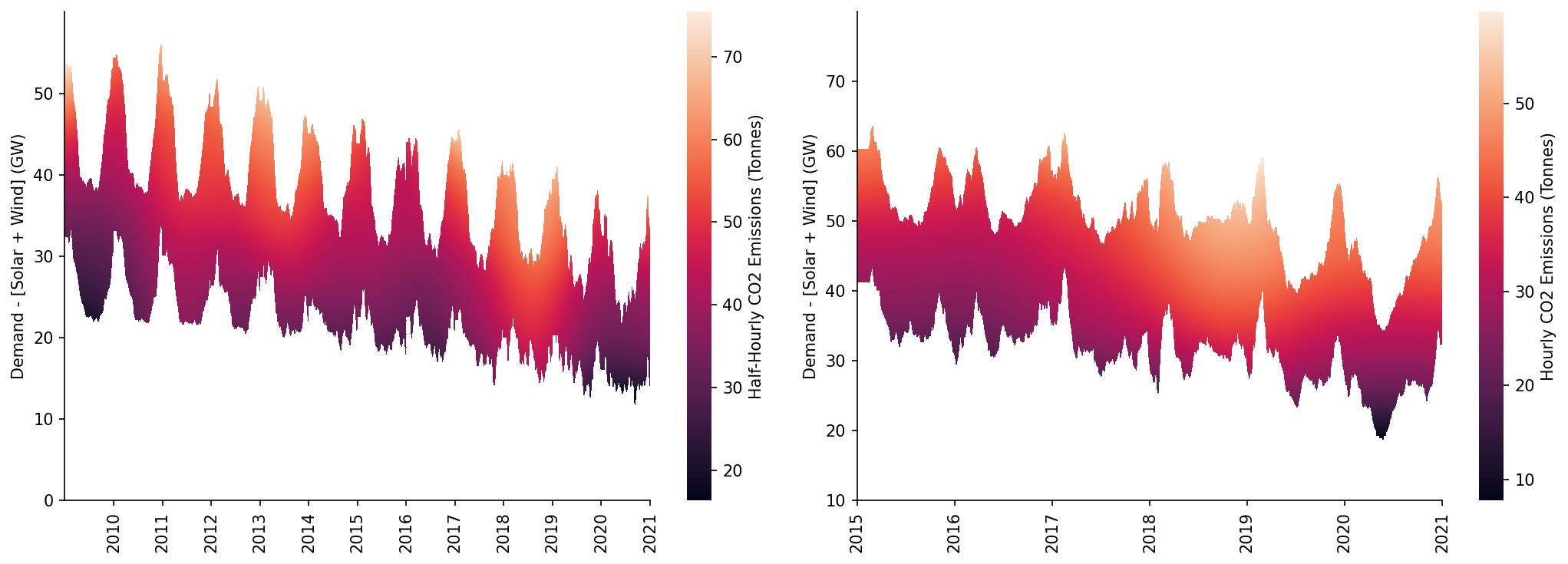

Plots¶

In this section we'll generate some of the plots needed for the paper, starting with the heatmap of the price surfaces

fig, axs = plt.subplots(dpi=150, ncols=2, figsize=(14, 5))

# GB

ax = axs[0]

min_y = 0

max_y = 60

htmp = sns.heatmap(df_pred[min_y:max_y].where(df_pred_mask[min_y:max_y], np.nan).iloc[::-1], ax=ax, cbar_kws={'label': 'Half-Hourly CO2 Emissions (Tonnes)'})

set_ticks(ax, np.arange(min_y, max_y, 10), axis='y')

set_date_ticks(ax, '2010-01-01', '2021-01-01', freq='1YS', date_format='%Y', axis='x')

for _, spine in htmp.spines.items():

spine.set_visible(True)

eda.hide_spines(ax)

ax.set_ylabel('Demand - [Solar + Wind] (GW)')

# DE

ax = axs[1]

min_y = 10

max_y = 80

htmp = sns.heatmap(df_DE_pred[min_y:max_y].where(df_DE_pred_mask[min_y:max_y], np.nan).iloc[::-1], ax=ax, cbar_kws={'label': 'Hourly CO2 Emissions (Tonnes)'})

set_ticks(ax, np.arange(min_y, max_y, 10), axis='y')

set_date_ticks(ax, '2015-01-01', '2021-01-01', freq='1YS', date_format='%Y', axis='x')

for _, spine in htmp.spines.items():

spine.set_visible(True)

eda.hide_spines(ax)

ax.set_ylabel('Demand - [Solar + Wind] (GW)')

fig.tight_layout()

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\sklearn\utils\validation.py:63: FutureWarning: Arrays of bytes/strings is being converted to decimal numbers if dtype='numeric'. This behavior is deprecated in 0.24 and will be removed in 1.1 (renaming of 0.26). Please convert your data to numeric values explicitly instead.

return f(*args, **kwargs)

C:\Users\Ayrto\anaconda3\envs\MOE\lib\site-packages\sklearn\utils\validation.py:63: FutureWarning: Arrays of bytes/strings is being converted to decimal numbers if dtype='numeric'. This behavior is deprecated in 0.24 and will be removed in 1.1 (renaming of 0.26). Please convert your data to numeric values explicitly instead.

return f(*args, **kwargs)

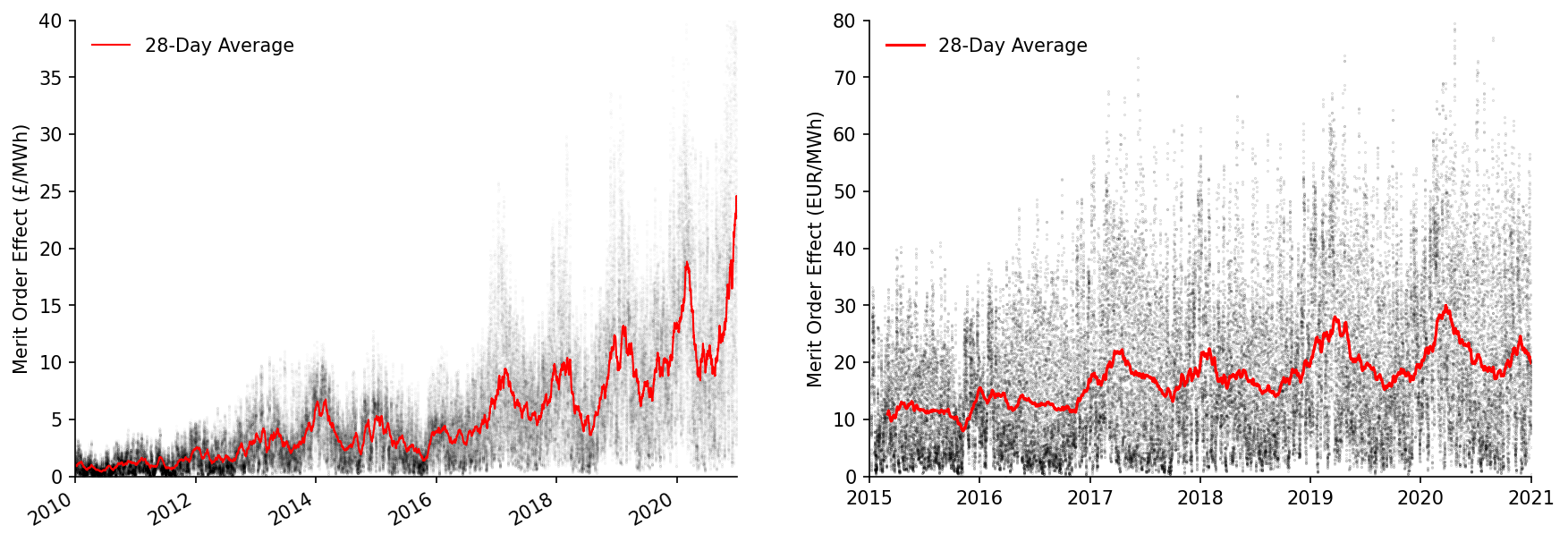

We'll also plot the MOE time-series

fig, axs = plt.subplots(dpi=150, ncols=2, figsize=(14, 5))

# GB

ax = axs[0]

ax.scatter(s_GB_MOE.index, s_GB_MOE, s=0.01, alpha=0.1, color='k', label=None)

s_GB_MOE_rolling.plot(color='r', linewidth=1, ax=ax, label='28-Day Average')

eda.hide_spines(ax)

ax.set_ylim(0, 40)

ax.set_xlim(pd.to_datetime('2010'), pd.to_datetime('2021'))

ax.set_xlabel('')

ax.set_ylabel('Merit Order Effect (£/MWh)')

ax.legend(frameon=False)

# DE

ax = axs[1]

ax.scatter(s_DE_MOE.index, s_DE_MOE, s=0.05, alpha=0.3, color='k', label=None)

ax.plot(s_DE_MOE_rolling.index, s_DE_MOE_rolling, color='r', linewidth=1.5, label='28-Day Average')

eda.hide_spines(ax)

ax.set_ylim(0, 80)

ax.set_xlim(pd.to_datetime('2015'), pd.to_datetime('2021'))

ax.set_xlabel('')

ax.set_ylabel('Merit Order Effect (EUR/MWh)')

ax.legend(frameon=False)

<matplotlib.legend.Legend at 0x22c22be1040>

Saving Results¶

Additionaly we'll save the time-series predictions and model metrics, starting with the GB time-series

df_GB_results_ts = pd.DataFrame({

'prediction': s_GB_pred_ts_dispatch,

'counterfactual': s_GB_pred_ts_demand,

'observed': s_GB_price,

'moe': s_GB_MOE

})

df_GB_results_ts.head()

| local_datetime | prediction | counterfactual | observed | moe |

|---|---|---|---|---|

| 2009-01-01 00:00:00+00:00 | 37.2034 | 37.3134 | 58.05 | 0.109938 |

| 2009-01-01 00:30:00+00:00 | 37.3134 | 37.5351 | 56.33 | 0.221756 |

| 2009-01-01 01:00:00+00:00 | 36.7685 | 36.9851 | 52.98 | 0.216574 |

| 2009-01-01 01:30:00+00:00 | 35.5952 | 35.8076 | 50.39 | 0.212469 |

| 2009-01-01 02:00:00+00:00 | 34.8494 | 35.0631 | 48.7 | 0.213697 |

Which we'll save to csv

df_GB_results_ts.to_csv('../data/results/GB_price.csv')

Then the DE time-series

df_DE_results_ts = pd.DataFrame({

'prediction': s_DE_pred_ts_dispatch,

'counterfactual': s_DE_pred_ts_demand,

'observed': s_DE_price,

'moe': s_DE_MOE

})

df_DE_results_ts.to_csv('../data/results/DE_price.csv')

df_DE_results_ts.head()

| local_datetime | prediction | counterfactual | observed | moe |

|---|---|---|---|---|

| 2015-01-04 23:00:00+00:00 | 24.4963 | 34.5304 | 22.34 | 10.0341 |

| 2015-01-05 00:00:00+00:00 | 23.7584 | 33.626 | 17.93 | 9.86759 |

| 2015-01-05 01:00:00+00:00 | 23.6626 | 33.9245 | 15.17 | 10.2619 |

| 2015-01-05 02:00:00+00:00 | 24.1342 | 34.5315 | 16.38 | 10.3973 |

| 2015-01-05 03:00:00+00:00 | 24.9343 | 36.2104 | 17.38 | 11.276 |

And finally the model metrics for both

model_accuracy_metrics = {

'DE_dispatch': DE_dispatch_metrics,

'DE_demand': DE_demand_metrics,

'GB_dispatch': GB_dispatch_metrics,

'GB_demand': GB_demand_metrics

}

with open('../data/results/price_model_accuracy_metrics.json', 'w') as fp:

json.dump(model_accuracy_metrics, fp)

JSON(model_accuracy_metrics)

<IPython.core.display.JSON object>